Understanding Your Future Franchisees’ Financial Journey

The cost to start a franchise and financing options are among the biggest considerations for potential franchisees. As a franchisor, understanding this financial landscape is crucial for attracting qualified candidates and building a sustainable network.

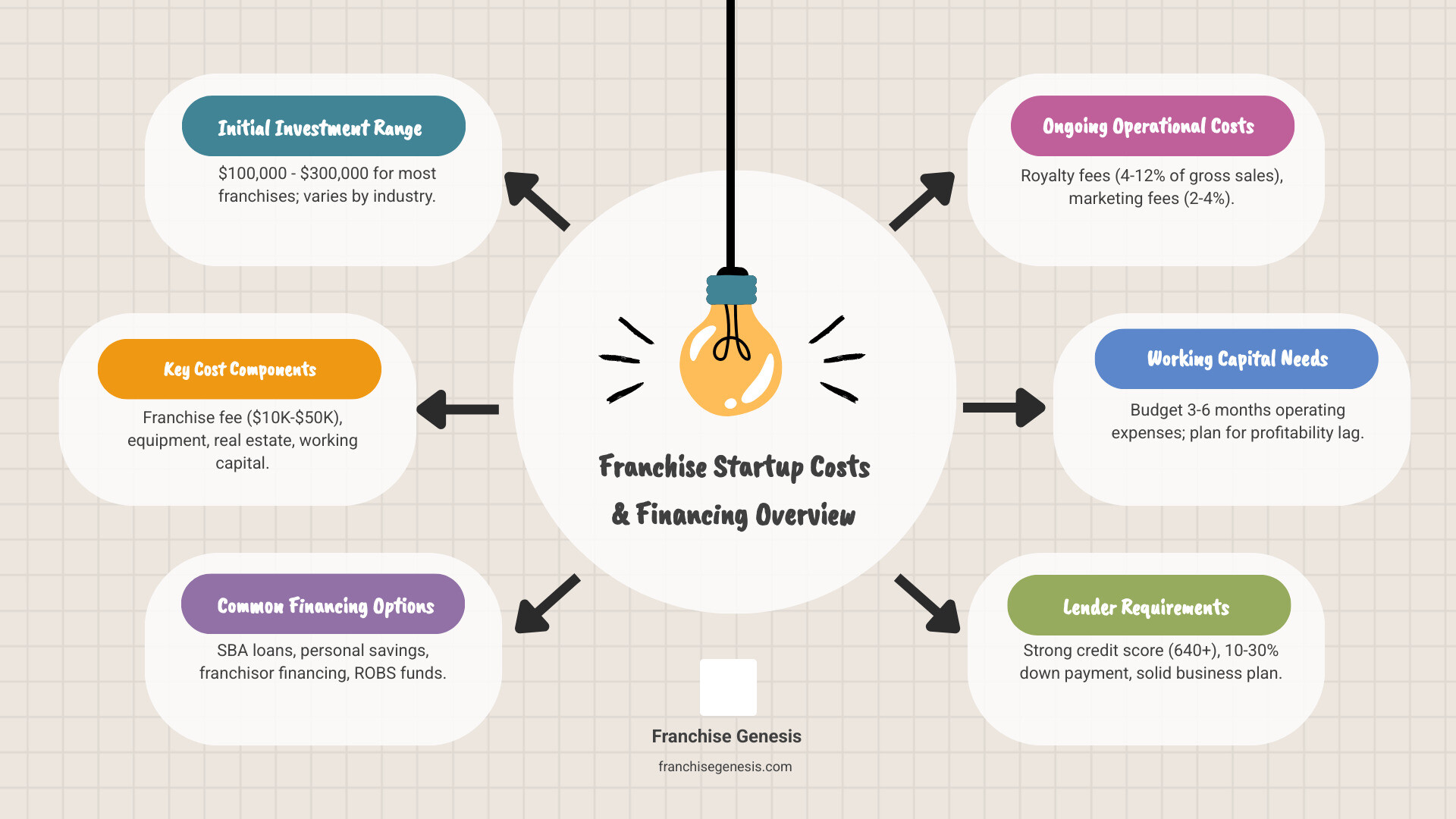

Quick Overview: Franchise Startup Costs & Financing

- Initial Investment Range: $100,000 – $300,000 for most franchises, but can be as low as $10,000 or over $750,000 depending on the industry.

- Key Cost Components: Franchise fee ($10,000-$50,000), equipment, real estate, working capital.

- Common Financing Options: SBA loans, personal savings, franchisor financing, ROBS retirement funds.

- Ongoing Costs: Royalty fees (4-12% of gross sales), marketing fees (2-4%).

- Lender Requirements: Strong credit score (640+), 10-30% down payment, solid business plan.

Your franchisees will need to steer franchise fees, equipment costs, real estate expenses, and working capital, all while securing financing that often requires a significant down payment from personal funds. Understanding these realities helps you structure your franchise model to attract serious candidates and set realistic expectations.

As Monique Pelle-Kunkle, Vice President of Operations at Franchise Genesis, I’ve guided hundreds of franchisors through structuring their financial models. My experience has shown me that transparent financial planning is the foundation of sustainable franchise growth, and it starts with a clear understanding of the cost to start a franchise and financing options from both sides of the equation.

Deconstructing the Franchisee’s Initial Investment

When you franchise your business, one of the most crucial conversations with potential franchisees revolves around money. The cost to start a franchise and financing options involve a detailed breakdown of various expenses that create the complete investment picture.

This comprehensive approach helps your potential franchisees create realistic budgets and demonstrates your professionalism as a franchisor, attracting serious, qualified candidates. All investment details must be clearly outlined in your Franchise Disclosure Document (FDD), which serves as the financial roadmap for your system. Getting this breakdown right is a key reason Why You Should Franchise your business, as it creates a replicable financial model.

The Initial Franchise Fee: Your Gateway to Growth

The initial franchise fee is the upfront payment for a franchisee to enter your proven business system. It grants them the right to use your brand name and benefit from your established reputation.

Most franchise fees fall between $10,000 and $50,000, varying by industry and the level of support you provide. This payment typically covers your brand license, comprehensive initial training, and ongoing support during the startup phase. It may also include site selection assistance, initial marketing materials, and access to proprietary software.

While the fee is generally non-negotiable, you can build in incentives to attract qualified candidates, such as discounts for veterans or deferred payment options for exceptional applicants.

Build-Out, Equipment, and Supply Chain Costs

After the initial fee, the main investment begins. These costs transform a basic setup into a fully functioning version of your business.

- Real estate costs can be substantial for brick-and-mortar concepts, including security deposits, rent, and leasehold improvements to match brand standards.

- Specialized equipment is another major expense, varying dramatically by industry. A food franchise needs kitchen equipment, while a fitness concept needs exercise machines.

- Initial inventory is required before serving the first customer. This could be food ingredients, retail products, or cleaning supplies, with costs varying widely by business type.

As your system grows, a strong Franchise Supply Chain becomes vital to ensure franchisees access quality products at competitive prices, maintaining brand consistency.

“Hidden” Startup Costs and Planning for the Unexpected

Certain expenses can surprise new franchisees if not planned for. Helping them budget for these less obvious costs is key to their success.

- Working capital is the cash cushion needed to cover operating and personal living expenses while the business ramps up. Budgeting for three to six months of expenses is crucial.

- Professional fees for legal, accounting, and consulting services can add up quickly.

- Business licenses and permits are required and vary by location and industry.

- Insurance coverage (general liability, property, workers’ compensation) is non-negotiable from day one.

- Grand opening marketing requires a dedicated budget for advertising and promotions to generate initial customer awareness.

By helping potential franchisees understand and budget for these expenses, you set them up for success and financial stability from the start.

Understanding the Ongoing Financial Commitment for Franchisees

Once a franchise is open, the initial investment gives way to recurring financial obligations that keep the business running and growing.

These ongoing costs are investments in the continued success of their business and your entire system. They include royalty fees, marketing fund contributions, payroll, rent, and other operational expenses. As a franchisor, helping your franchisees understand these commitments sets realistic expectations for profitability. When your franchisees thrive, your entire system benefits, creating a strong foundation for Franchise Growth Strategies. The key is ensuring your fee structure provides real value back to your franchisees.

Royalty and Marketing Fund Contributions

Two main ongoing fees form the financial foundation of your franchise system: royalty fees and marketing fund contributions.

Royalty fees, typically 4% to 12% of gross sales, are the franchisee’s payment for ongoing training, operational support, and access to your evolving business model. This fee structure aligns your interests with your franchisees’ success; as their sales grow, so do your resources to reinvest in the system.

Marketing fund contributions, usually another 2% to 4% of gross sales, are pooled to create large-scale marketing campaigns that individual locations couldn’t afford. These funds support national advertising, brand development, and digital marketing that benefit the entire system. Most franchisees will also need to invest in local marketing to drive traffic to their specific location.

Operational Expenses and Long-Term Budgeting

Day-to-day operational costs require diligent financial management from your franchisees.

- Employee payroll and training costs are often the largest ongoing expense, including salaries, benefits, and taxes. Successful franchisees also invest in continuous training for their teams.

- Rent and utilities for a physical location create a fixed overhead that must be factored into all financial projections.

- Technology fees and software subscriptions for POS systems, CRM software, and other tools are essential for efficient operations and come with recurring costs.

- Miscellaneous operating costs cover everything else, from office supplies and maintenance to insurance premiums.

Long-term thinking is critical. Guide your franchisees in developing a comprehensive 3- to 5-year financial forecast with realistic revenue projections and expense plans. Smart franchisees also build emergency funds and plan for seasonality to manage cash flow effectively. By helping your franchisees plan for these ongoing commitments, you build a stronger, more resilient franchise system.

A Franchisor’s Guide to The Cost to Start a Franchise and Financing Options

As you franchise your business, one of your most important roles is helping qualified candidates understand the cost to start a franchise and financing options. You become a guide who helps turn entrepreneurial dreams into financial reality.

While you won’t be writing checks, your understanding of financing can make or break a candidate’s ability to join your system. Most franchisees will rely on SBA loans, personal savings, franchisor-facilitated financing, or retirement fund rollovers. Your job is to position your franchise opportunity to appeal to both serious investors and the financial institutions that fund them. At Franchise Genesis, our Services for Franchisors and Franchisees include helping you build these crucial financing partnerships.

How to structure the cost to start a franchise and financing options for your brand

Your financing strategy impacts the quality and quantity of candidates who can join your system. Smart franchisors actively facilitate funding.

- Build relationships with preferred lenders who understand the franchise model and your industry. This streamlines the process for your candidates.

- Offer direct financing for portions of the investment, such as the franchise fee, or provide deferred payment plans.

- Provide incentive discounts for veterans, minorities, or multi-unit developers.

Your goal is to set realistic liquid capital requirements and net worth standards that tell a compelling story to lenders. Financial transparency is also a key part of your Franchise Sales & Marketing, giving candidates the confidence to invest.

Navigating SBA Loans and Government-Backed Programs

SBA loans are one of the most accessible funding sources for franchisees. The Small Business Administration doesn’t lend money directly but guarantees a portion of loans made by commercial lenders, reducing the bank’s risk.

- The SBA 7(a) loan is the most common option, covering working capital, equipment, and real estate.

- The SBA 504 loan program is useful for purchasing major assets like real estate or equipment.

Getting your brand listed on the SBA Franchise Directory is a game-changer. It means the SBA has pre-reviewed your FDD, which signals legitimacy to lenders and streamlines the loan process for your franchisees. You can find more information on SBA Type 7(a) loans on the SBA website.

How to evaluate a franchisee’s plan for the cost to start a franchise and financing options

Your role is to assess each candidate’s financial preparedness. Lenders typically require candidates to contribute 10% to 30% of the total investment from their own personal savings. This demonstrates commitment and reduces risk.

Other common funding sources include home equity loans or lines of credit. Another popular but complex option is the Rollover as Business Startup (ROBS), which allows candidates to use retirement funds (401k or IRA) without penalties. This strategy is complex and carries significant risks if not executed properly, as noted by sources like the Wall Street Journal’s guide on Financing with retirement funds.

Help candidates think through their strategy realistically. The strongest franchisees typically have access to funds beyond the minimum requirements, giving them a financial cushion for unexpected challenges.

Preparing Your Franchisees for Financial Scrutiny

As potential franchisees get serious about joining your system, they will face a thorough financial examination from both you and potential lenders. Your role is to prepare them to become attractive investment opportunities for banks.

This preparation involves careful due diligence, meticulous documentation, and a clear understanding of how credit history impacts financing. When you guide franchisees through this successfully, you’re not just helping them secure funding—you’re building a stronger, more resilient franchise network. This financial preparedness is key to Understanding the Key to Building a Thriving Franchise Network.

The Franchise Disclosure Document (FDD): Your Financial Blueprint

The Franchise Disclosure Document (FDD) is your transparent financial roadmap, giving prospective franchisees the information they need to understand the cost to start a franchise and financing options.

Three sections are critical for financing:

- Item 5 (Initial Fees): Breaks down every upfront payment made to you before opening.

- Item 6 (Other Fees): Outlines the ongoing financial relationship, including royalties and marketing contributions.

- Item 7 (Estimated Initial Investment): Provides a detailed, line-by-line breakdown of the total cost to open and operate for the first few months, with low and high estimates.

You are legally required to provide the FDD at least 14 days before any contracts are signed or money is paid, ensuring franchisees have time for due diligence. For multi-state expansion, understanding the Franchise Registration States Guide is also crucial for compliance.

The Importance of a Franchisee’s Credit and the “5 Cs”

A strong credit score (generally 640 or higher for SBA loans) is a franchisee’s financial first impression. Lenders use The 5 Cs of Credit to assess risk:

- Capacity: The franchisee’s ability to repay the loan, based on debt-to-income ratios and projected cash flow.

- Capital: The personal investment or “skin in the game,” typically 10% to 30% of the total cost.

- Collateral: Assets (real estate, equipment) pledged to secure the loan, providing a safety net for the lender.

- Conditions: The loan’s purpose, its terms, and the overall economic and industry climate.

- Credit History: The track record of managing past debt, as shown in credit reports.

Helping your franchisees understand and strengthen these five areas dramatically improves their chances of securing financing.

Financial Documents Lenders Require from Franchisees

Providing a checklist of required documents helps your franchisees prepare for the loan application process, demonstrating professionalism and organization.

Key documents include:

- A comprehensive business plan with market analysis and 3-5 year financial projections.

- Personal financial statements detailing all assets and liabilities.

- Three years of personal tax returns and any existing business tax returns.

- Recent personal and business bank statements.

- Resumes of all key principals highlighting relevant experience.

- Legal entity formation documents (LLC, corporation, etc.).

- Your Franchise Disclosure Document (FDD) and the signed franchise agreement.

By helping franchisees gather these documents, you set them up for a smoother financing experience.

Conclusion

When franchising your business, a deep understanding of the cost to start a franchise and financing options is a powerful tool for attracting the right partners. This isn’t just about numbers; it’s about building trust and relationships with people investing in your proven model.

By being transparent about every cost, from the initial fee to ongoing royalties, you become a trusted guide for your future franchisees. You help them steer scrutiny from lenders and prepare them for the realities of business ownership. The most successful franchise systems view their franchisees’ financial success as inseparable from their own.

Strategic financial planning creates a win-win relationship. Profitable franchisees build a sustainable system, strengthening your brand for years to come. To successfully Franchise Your Business, mastering your future franchisee’s financial journey is essential.

At Franchise Genesis, we guide business owners through this exact process, helping structure costs and financing support to attract qualified candidates. For expert help in building your franchise model for long-term success, explore our Services for Franchisors and Franchisees.