Why Finding the Right Funding Strategy Makes or Breaks Your Franchise Expansion

Securing the best franchise financing means matching your needs with the right financial tools. Whether it’s government-backed loans for infrastructure, bank financing for operations, or franchisee funding programs to fuel growth, the right strategy is crucial.

Top Franchise Financing Options:

- SBA 7(a) Loan Program – Up to $5 million with government guarantees covering 75–85% of the loan amount.

- Traditional Bank Loans – Faster processing but stricter requirements.

- Business Lines of Credit – Flexible working capital for ongoing needs.

- Alternative Funding – Angel investors or personal capital for equity-based growth.

- In-House Franchisee Programs – Direct financing to attract quality candidates.

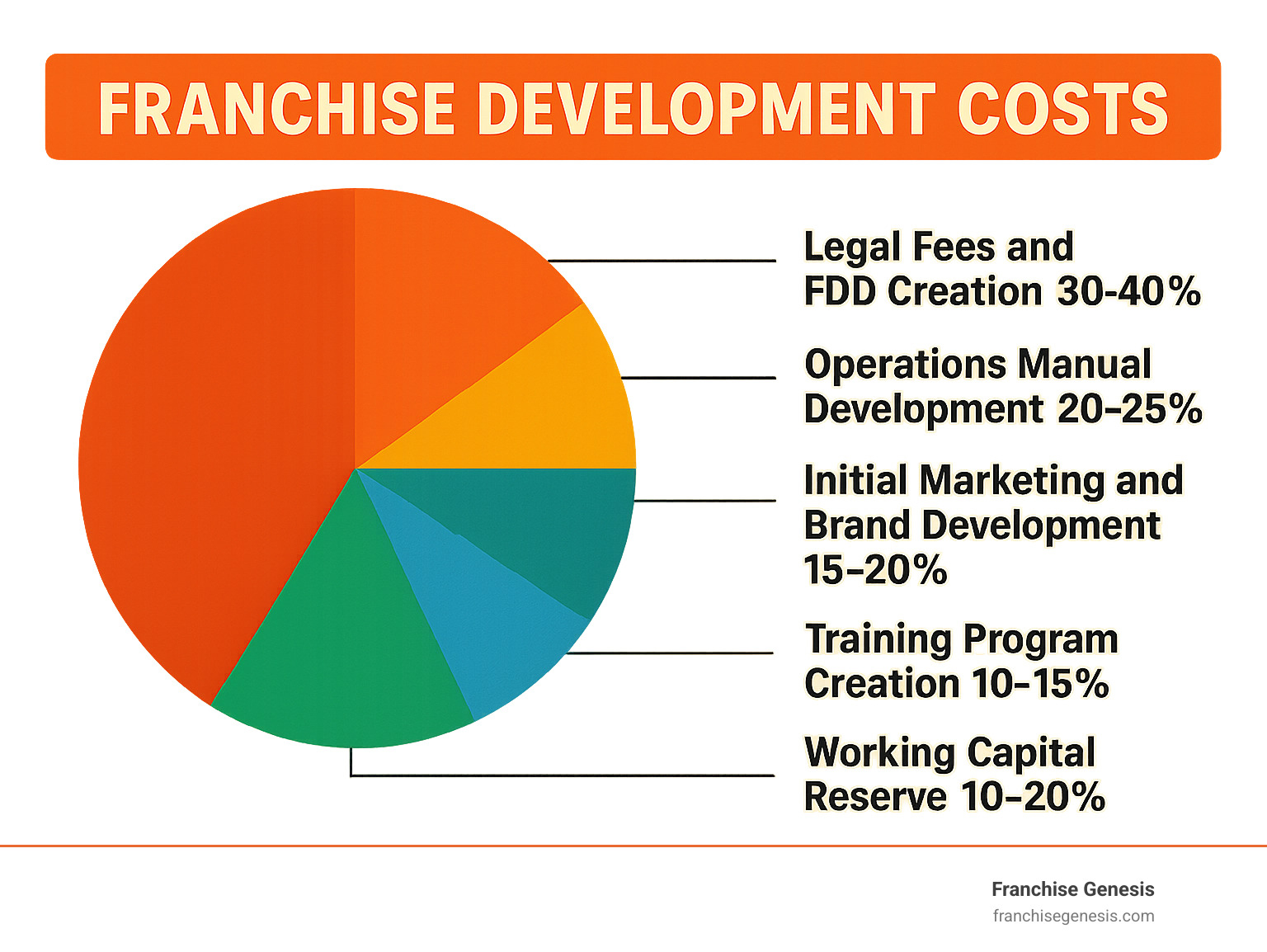

Developing a franchise system costs around $350,000 on average, though this varies. As one expert noted, “Not incorporating enough working capital into project costs is one of the reasons many franchises fail.”

Choosing the wrong funding can leave you cash-strapped, while the right mix provides the flexibility to scale and attract top-tier franchisees.

I’m Monique Pelle-Kunkle, VP of Operations at Franchise Genesis. I’ve guided dozens of business owners through franchise development, securing the best franchise financing for sustainable growth and scaling systems to over 100 locations.

Funding Your Initial Franchise System Development

Before welcoming your first franchisee, you must invest in creating your franchise system’s backbone. This includes legal fees for your Franchise Disclosure Document (FDD), developing a comprehensive Franchise Operations Manual, and initial marketing to attract pioneers.

How do you pay for this? Most business owners use a mix of business loans, lines of credit, retained earnings, or equity investors. Finding the best franchise financing means choosing the path that fits your situation.

Traditional Bank Loans vs. Lines of Credit

Banks typically offer two main options: term loans and lines of credit.

Term loans provide a lump sum upfront, repaid over a set period with predictable payments. They are ideal for significant, one-time investments like technology systems or FDD creation. The benefit is a fixed interest rate, but banks require a solid financial track record and your own capital contribution. While conventional loans may close faster than government-backed ones, they often have shorter repayment terms, which can strain early cash flow.

Lines of credit offer a flexible financial safety net. You’re approved for a maximum amount but only pay interest on what you use, making them perfect for working capital and bridging cash flow gaps. The trade-off is a variable interest rate, which can make budgeting less predictable. For specific programs, institutions like CIBC offer custom solutions, which you can explore at Banking for Franchises at CIBC.

Alternative Funding: Investors and Personal Capital

Sometimes the best financing isn’t from a bank. Many franchisors fund development by thinking outside the traditional lending box.

Angel investors provide capital in exchange for equity. Beyond money, they can offer valuable industry experience and connections. However, giving up equity means sharing control and future profits, which can become expensive if your franchise takes off.

Personal capital is a common starting point, using savings or a Home Equity Line of Credit (HELOC). A HELOC can provide substantial capital at good rates, but it puts your home at risk as collateral. It’s wise to borrow only a portion of your available equity.

A Rollover as Business Startups (ROBS) strategy lets you use retirement funds without penalties or taxes. You maintain full control and avoid debt, but you risk your retirement savings if the business struggles. This requires careful planning with a financial professional to follow IRS rules.

The right approach depends on your risk tolerance and how much control you want to retain. We help business owners find the best franchise financing solution for their vision. Learn more about the financial side of franchising your business.

Government-Backed vs. Conventional Loans for Expansion

Once your system is developed, you may need capital to expand corporate infrastructure, like a training center or advanced technology platforms to support a growing network. This is where choosing between government-backed and conventional loans is crucial for securing the best franchise financing.

The SBA 7(a) and 504 Loan Programs

For U.S. business owners, the Small Business Administration (SBA) offers two powerhouse options:

- SBA 7(a) Loan: Ideal for working capital, equipment, or leasehold improvements. You can access up to $5 million, and the SBA guarantees up to 85% for loans under $150,000 and 75% for larger amounts, reducing lender risk and improving approval odds. Terms can stretch to 10–25 years, keeping payments manageable. Explore details at the official SBA 7(a) Loans page.

- SBA 504 Loan: Designed for major fixed assets, such as real estate or large equipment. It combines a bank loan with an SBA-backed debenture, often requiring only 10% borrower equity.

The key advantage of both programs is access to long repayment terms and lower down-payment requirements, helping you preserve cash for day-to-day operations.

Conventional Business Loans

Conventional bank loans remain a cornerstone of expansion financing. With a solid financial track record and an established bank relationship, they can offer faster processing times and competitive rates. Banks may provide lower origination costs and interest rates to well-qualified borrowers.

However, banks typically have stricter criteria and may require more substantial collateral than government-backed programs. They prefer lending to established businesses with proven financial histories. Maintaining strong relationships with your banking partners is key to accessing this type of funding when you need it.

Understanding the ‘5 Cs of Credit’ for Approval

Lenders evaluate your business using the ‘5 Cs of Credit.’ Understanding these is essential for any funding application.

- Character: Your reputation and history of honoring financial commitments.

- Capacity: Your business’s cash flow and ability to repay the loan.

- Capital: Your personal investment in the business, showing you have “skin in the game.”

- Conditions: The purpose of the loan and the broader economic environment.

- Collateral: Assets you pledge as security for the loan.

Addressing each of these areas improves your chances of securing funding. For more on building a successful expansion strategy, see our Franchising Insights page.

Setting Up Your Franchisees for Success: The Best Franchise Financing Programs

Your success as a franchisor is tied to your franchisees’ ability to succeed, and that starts with securing adequate funding. While you won’t write them a check, you can play a crucial role in helping them find the best franchise financing options.

Building Relationships with Lenders

One of the smartest investments you can make is building relationships with lenders who understand franchising. Create a preferred lender list of institutions that know your industry and business model. Educate these lenders by sharing your FDD, providing business plan templates, and showing them data on your existing units’ financial performance. When lenders see consistent profitability, they view your franchisees as lower-risk investments. This streamlines the application process for your candidates and becomes a powerful recruitment tool. Learn more about building these partnerships in our guide to Building a Thriving Franchise Network.

What Lenders Look for to Offer the Best Franchise Financing

When a franchisee applies for a loan, lenders want to see evidence that they will succeed. As the franchisor, you can strengthen their case by highlighting:

- Strong franchisor support: Comprehensive training and ongoing operational assistance.

- Proven unit economics: Consistent profitability and healthy margins across your network.

- A detailed operations manual: A well-structured manual that demonstrates a replicable system.

- A solid business plan template: A professional foundation for franchisees to build upon.

- The franchisee’s credit history: While you can’t control this, you can guide candidates on lender expectations.

Creating an In-House Program: The Ultimate in Best Franchise Financing Support

Some franchisors create their own in-house financing programs to attract top-quality candidates. This can be a powerful differentiator.

- Direct financing: You provide a portion of the startup capital, perhaps for equipment or inventory. This could be a loan or a deal tied to a percentage of future sales.

- Equipment leasing programs: Negotiate bulk deals with leasing companies to pass better terms on to your franchisees.

- Royalty deferment: Allow new franchisees to delay royalty payments for the first few months to help them manage initial cash flow.

These programs lower the barrier to entry and show confidence in your system. However, they require significant capital and careful navigation of legal compliance as a lender. This decision shouldn’t be taken lightly, but it can be the ultimate expression of partnership. For more growth strategies, explore our insights on Franchise Growth Strategies.

Key Considerations and Pitfalls in Franchise Funding

Franchising your business is exciting, but it’s filled with potential financial pitfalls. Securing the best franchise financing requires understanding the risks. As one expert noted, “Not incorporating enough working capital into project costs is one of the reasons many franchises fail.” Effective risk management and financial forecasting are essential.

Crafting a Lender-Ready Franchise Business Plan

A well-crafted business plan is the cornerstone of any funding application. It’s a compelling story backed by solid numbers. Key components include a concise executive summary, a deep market analysis, and three-to-five-year financial projections (income statements, balance sheets, cash flow). Crucially, you must clearly detail your use of funds and present a rock-solid repayment strategy. This plan is not just for lenders; it’s your strategic blueprint. For help refining your approach, visit our page on a Proven Sales Strategy.

The Hidden Costs of Expansion

It’s often the underestimated costs that cause problems. Plan for these ongoing expenses from the beginning:

- Working capital: Sufficient cash flow for daily operations and unexpected costs.

- Ongoing support staff: As your network grows, so does the need for training and support personnel.

- Technology upgrades: Essential for maintaining efficiency and staying competitive.

- Marketing fund contributions: Ongoing investment in system-wide brand recognition.

- Legal compliance updates: Evolving franchise laws require continuous attention and funding.

The Risk of Personal Guarantees

A personal guarantee is a promise that if your business defaults on a loan, you are personally responsible for repaying it, putting your home, savings, and other assets at risk. Understanding this liability is paramount. While many conventional loans require a full personal guarantee, SBA-backed loans may offer more flexible collateral requirements or partial guarantees that share risk with lenders. When evaluating loans, always scrutinize the guarantee requirements to balance access to capital with reasonable personal risk. You can learn more about the implications at More about personal guarantees.

Frequently Asked Questions about Funding Your Franchise Expansion

As I work with business owners, the same questions about the financial side of franchising come up repeatedly. Here are the answers to the most common concerns.

How much capital do I need to turn my business into a franchise?

There’s no single answer, as costs vary. Your largest expenses will be legal fees for the Franchise Disclosure Document (FDD) and franchise agreements. You must also budget for developing a comprehensive operations manual and training program, plus initial marketing to attract your first franchisees. The total investment to develop your system typically ranges from tens of thousands to over a hundred thousand dollars. A detailed plan is essential for securing funding.

Can I finance the franchise fee for my future franchisees?

Generally, you should not take out a loan to create a fund for your franchisees’ fees. Instead, you can facilitate best franchise financing for them. The most effective way is by building relationships with third-party lenders who understand franchising and will finance the fee as part of a larger loan package. For U.S. candidates, many lenders wrap the franchise fee into an SBA 7(a) loan or a conventional term loan. You can also establish equipment leasing programs or offer limited in-house financing for specific items to reduce their upfront cash needs.

How does my business’s financial health impact my ability to franchise?

Your existing business’s financial health is critical. Lenders will scrutinize your financials when you seek expansion funding, looking for consistent profitability and strong cash flow. Furthermore, potential franchisees will review your financial performance in the FDD to gauge the opportunity’s viability. A financially robust franchisor inspires confidence and attracts high-quality candidates, while a struggling one raises red flags. A strong balance sheet is crucial for securing funding and building a thriving network.

Conclusion

Finding the right funding for your franchise expansion is about setting your business up for sustainable growth. The path you choose—whether it’s a government-backed program like the CSBFL, a traditional bank loan, or an in-house financing program—will shape your franchise’s future.

Sustainable growth comes from careful planning, strong lender relationships, and robust support systems for your franchisees. The best franchise financing strategy is one that aligns with your specific goals and risk tolerance. Too many promising concepts stumble due to poor funding choices; don’t let that be your story.

At Franchise Genesis, we understand that every successful franchise starts with smart financial decisions. We guide business owners through these challenges, helping them secure the capital they need while avoiding common pitfalls.

Choosing the right path means having an experienced partner. The long-term success you envision starts with informed funding decisions today. Let our expert guidance help you build the foundation for a thriving franchise network.

Your franchise empire is waiting. Let’s make it happen together. Get expert help with our services for franchisors and franchisees.