Why Understanding Franchise Financing Trends Matters More Than Ever

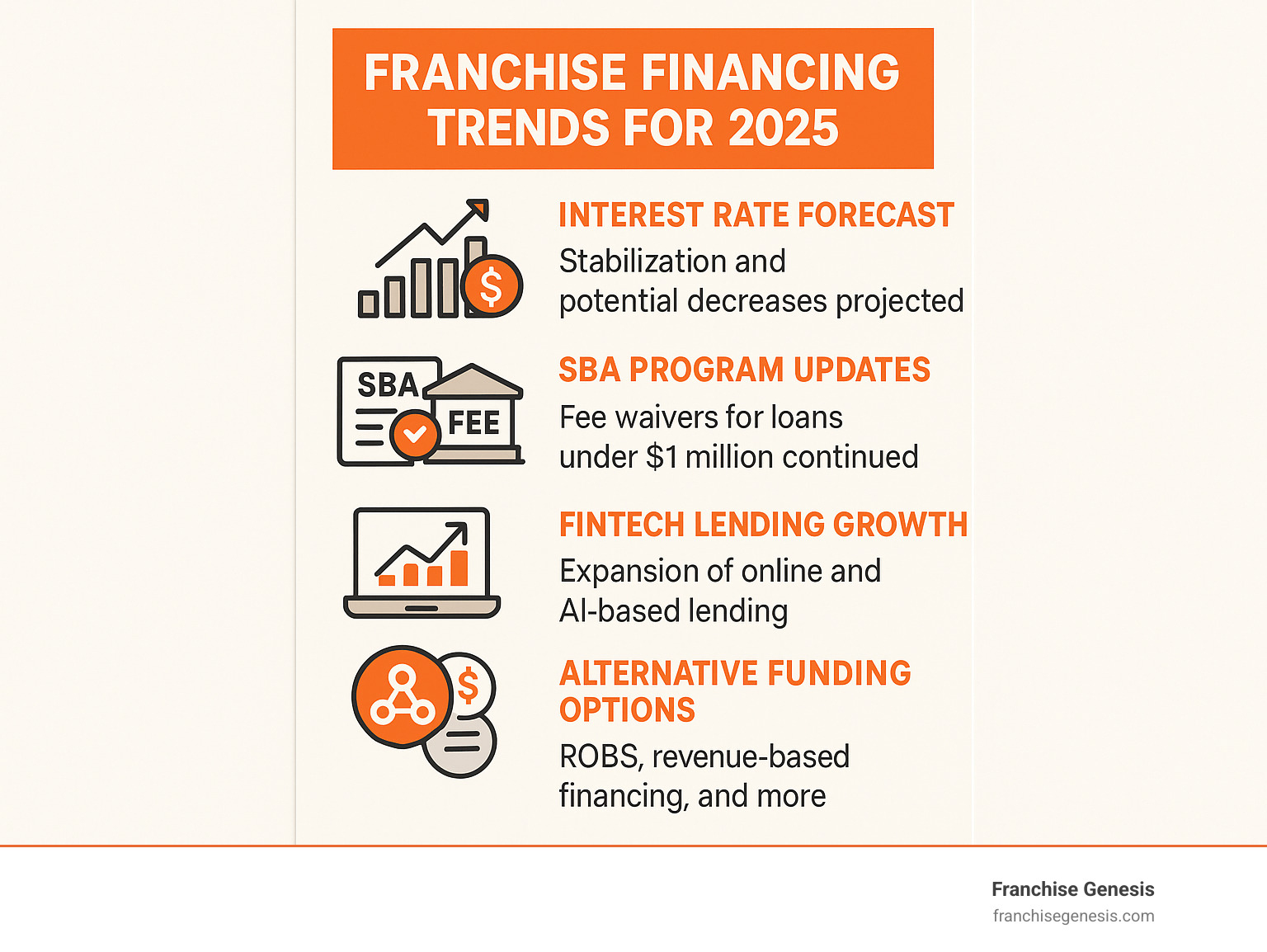

Franchise financing trends are reshaping how business owners approach expansion in 2025. The landscape has fundamentally changed, with interest rate stabilization, new SBA regulations, and the rise of fintech solutions creating both opportunities and challenges for franchisors.

Key Franchise Financing Trends for 2025:

- Interest Rate Relief: Economists forecast stabilization and potential decreases in rates, making expansion more affordable

- SBA Program Changes: Fee waivers for loans under $1M continue through fiscal year 2025, but the elimination of the SBA Franchise Directory shifts due diligence to lenders

- Fintech Revolution: Online lenders and AI-driven underwriting are providing faster, more flexible funding options

- Alternative Funding Growth: ROBS, revenue-based financing, and crowdfunding are gaining traction as viable alternatives

- Multi-Unit Focus: Lenders increasingly favor portfolio lending for established franchisees seeking to scale

The U.S. franchise sector is projected to generate more than $936 billion in economic output in 2025, opening 20,000 new locations. But here’s the challenge: while the industry is booming, the path to capital has never been more complex for your potential franchisees.

As Monique Pelle-Kunkle, Vice President of Operations at Franchise Genesis, I’ve guided hundreds of business owners through franchise development, witnessing how evolving franchise financing trends can make or break expansion plans. My experience scaling franchise concepts—including growing an ABA therapy franchise to over 100 locations in its first year—has shown me that understanding these trends isn’t optional for franchisors who want to build strong, sustainable networks.

The Shifting Capital Landscape: Macro-Economic and Regulatory Impacts

The economic winds of 2025 are shifting in ways that could make or break your franchise expansion plans. As someone who’s helped countless business owners steer these waters, I can tell you that understanding these changes isn’t just helpful—it’s essential for building a thriving franchise network.

Here’s what’s happening: economists are forecasting interest rate stabilization and potential decreases as we move through 2025. Combined with the franchise sector’s projected $936 billion economic output, this creates a promising environment for growth. But don’t pop the champagne just yet.

The inflation impact on startup costs and operational expenses means your potential franchisees need financing more than ever. Every dollar counts when you’re launching a new location, and rising costs can quickly turn an exciting opportunity into a financial stretch.

What’s really shaking things up are the evolving regulations from the Small Business Administration. These SBA SOP changes aren’t just bureaucratic shuffling—they’re fundamentally changing how lenders evaluate franchise opportunities. Some lenders are pulling back from franchise lending altogether because they’re unsure about new compliance requirements.

The political landscape adds another layer of complexity. While the recent presidential election’s immediate impact might just be short-term market fluctuations, its real influence will unfold throughout 2025. This makes strategic planning based on solid economic forecasts more critical than ever. For a deeper dive into what’s ahead, check out the 2025 franchising economic outlook.

Navigating the New SBA Loan Environment

SBA 7(a) loans have been the backbone of franchise financing for years, with 14% of franchisees securing funding through these programs. The good news? These loans still offer fantastic terms in 2025: down payments as low as 10%, repayment periods up to 10 years, and competitive interest rates.

Even better, the 2025 fee waivers continue for 7(a) loans of $1,000,000 or less through fiscal year 2025. That’s real money staying in your franchisees’ pockets instead of going to fees.

But here’s the game-changer: the SBA Franchise Directory discontinuation in 2023 shifted everything. Lenders now carry the full burden of determining franchise eligibility. This isn’t just a paperwork change—it’s creating delays, increased scrutiny, and sometimes outright denials for unprepared franchise systems.

What does this mean for you as a franchisor? Lender due diligence now falls heavily on your documentation. Lenders are asking for confirmation emails from franchisors, verifying that no modifications have been made to franchise agreements. Some are requesting additional financial documentation that wasn’t required before.

The FDD importance cannot be overstated in this new environment. Your Franchise Disclosure Document is now the primary tool lenders use to evaluate your franchise system. A robust, transparent FDD with a compelling Item 19 (Financial Performance Representation) can be the difference between a quick approval and a lengthy denial for your candidates.

This is why having your franchise house in perfect order matters more than ever. For guidance on SBA loans for small businesses, your franchisees need systems that give lenders confidence from day one.

How Interest Rate Fluctuations Affect Your Franchise Sales

Interest rates directly impact your franchisee affordability—and ultimately, your ability to close deals. When rates climb, monthly payments increase, potentially pricing out qualified candidates or forcing them to consider smaller investment opportunities.

The cost of borrowing changes everything. In 2023, high interest rates contributed to decreased private equity investment across the franchise sector. Many potential franchisees simply couldn’t make the numbers work with liftd borrowing costs.

Here’s where 2025 gets interesting: the forecasted rate stabilization could be a game-changer for your sales pipeline. A drop from 10.5% to 9% on an SBA 7(a) loan might not sound dramatic, but it translates to thousands of dollars in savings over the loan’s life. That’s money that improves your franchisees’ cash flow impact and makes your opportunity more attractive.

Monthly payment calculations become more favorable, opening doors for candidates who were previously on the fence. But remember—even with stabilizing rates, lenders are maintaining stricter qualification standards. Your candidates need stronger financial profiles and more detailed business plans.

Refinancing opportunities are also emerging for existing franchisees looking to expand. Those who secured financing at higher rates might now qualify for better terms, freeing up capital for additional locations.

The key is staying informed about these franchise financing trends and helping your candidates understand how timing affects their investment. Our Franchising Insights regularly track these economic shifts so you can guide your candidates with confidence.

Key Franchise Financing Trends Your Candidates Will Face

The world of franchise financing is evolving at breakneck speed, and as franchisors, we need to understand what our potential franchisees are up against. Gone are the days when a trip to the local bank was the only path to funding. Today’s franchise financing trends reveal a landscape that’s both more complex and more opportunity-rich than ever before.

What’s fascinating is how lenders are becoming more sophisticated about franchise financing. They’re digging deeper into unit economics, same-store sales data, and performance metrics. This means they understand the value of a proven business model, but they also expect transparency and solid performance data from franchise systems.

The challenge? While there are more funding options available, there’s also more complexity. Your candidates need guidance to steer everything from traditional bank loans to cutting-edge fintech solutions. The key insight from recent industry analysis is that franchise development is up, but access to growth capital depends heavily on a brand’s ability to demonstrate stability and performance. As highlighted in Franchise Development Is Up: But will the growth capital be?, transparent data is the golden ticket to open uping growth capital.

The Rise of Fintech and Alternative Funding Solutions

The financing revolution is here, and it’s being led by fintech platforms and online lenders that are rewriting the rules of franchise funding. These digital-first lenders are offering something traditional banks often can’t: speed and flexibility.

Picture this: instead of waiting weeks for a loan decision, your candidates can get conditional approvals in just days. AI-powered underwriting is making this possible, analyzing applications faster and often with more nuanced criteria than traditional methods. Many fintech platforms are also offering unsecured working capital loans, which can be a lifeline for franchisees who need quick access to funds without putting up collateral.

But the real game-changer in alternative funding is Rollovers as Business Startups (ROBS). This strategy allows your candidates to tap into their retirement funds—like a 401(k) or IRA—to invest in their franchise without the usual penalties or taxes. It’s brilliant because there’s no debt to repay, no interest charges, and it doesn’t impact their credit score. However, it’s crucial they work with specialized ROBS providers and understand the IRS rules on early distributions to stay compliant.

Revenue-based financing is another trend gaining momentum. Instead of fixed monthly payments, franchisees agree to share a percentage of their future revenue with investors. This creates a payment structure that flexes with their business performance—higher revenue means higher payments, but lower revenue means breathing room.

We’re also seeing growth in crowdfunding platforms where entrepreneurs can pitch their franchise concepts to a broader investor audience. While 19% of franchisees still rely on personal savings or support from family and friends, we’re advising caution on personal loans and Home Equity Lines of Credit due to the current interest rate environment.

Understanding these diverse options helps us guide candidates toward the funding strategy that best fits their situation and goals. It’s all part of building a strong foundation when you consider Why You Should Franchise your business.

Capital Strategies for Single vs. Multi-Unit Growth

Here’s where franchise financing trends get really interesting: the strategies for single-unit versus multi-unit development are becoming increasingly distinct, and smart franchisors are adapting their support accordingly.

Multi-unit ownership is becoming the new standard. More entrepreneurs are thinking bigger from day one, recognizing that multiple locations can provide better economies of scale and faster wealth building than single-unit ownership. This shift is driving demand for more sophisticated financing approaches.

For multi-unit developers, lenders are rolling out specialized products that recognize their unique needs. Portfolio lending is gaining traction—this approach uses the performance data from existing units as collateral and proof of concept for expansion funding. When a franchisee can show strong performance across their current locations, lenders become much more comfortable funding additional units.

Lines of credit are particularly popular with multi-unit owners because they provide flexible access to capital as new locations come online. Instead of taking a large lump sum upfront, franchisees can draw funds as needed throughout their expansion timeline. Expansion loans tied to specific growth milestones are another emerging trend, providing capital in stages as multi-unit owners hit predetermined performance targets.

Single-unit owners, on the other hand, typically focus on securing solid startup capital through SBA loans or traditional bank financing. Their primary goal is getting that first unit profitable and establishing a track record before considering expansion.

The key for us as franchisors is creating clear pathways for both approaches. We need expansion loan programs, preferred lender relationships, and financial projection templates that work for different growth strategies. Our Franchise Growth Strategies framework helps you build these comprehensive support systems that serve franchisees at every stage of their growth journey.

Empowering Your Franchisees: How to Build a Financially Strong Network

Picture this: you’ve built an amazing business concept, you’re ready to franchise, but your potential franchisees keep hitting roadblocks when it comes to financing. Sound familiar? As franchisors, we’re not just in the business of selling franchise units – we’re architects of success, building networks that thrive for the long haul.

The reality is that franchise financing trends show us that securing capital remains one of the biggest problems for potential franchisees. When we proactively address this challenge, something magical happens – we attract higher-quality candidates who are better positioned for success. This means rolling up our sleeves and getting involved in everything from preferred lender relationships to financial education and helping candidates prepare rock-solid documentation.

Think of it as setting the stage for success before the curtain even rises. When we establish realistic expectations about startup costs and guide candidates through the financing maze, we’re not just being helpful – we’re building the foundation for a financially robust network that can weather any storm.

Creating a “Financing-Friendly” Franchise System

Building a financing-friendly franchise system is like constructing a bridge between your candidates’ dreams and the capital they need to make those dreams reality. Lenders want to feel confident about their investments, and that confidence starts with how we structure our franchise systems.

The cornerstone of any financing-friendly system is a strong FDD with compelling Item 19 data. Think of your Franchise Disclosure Document as your franchise’s resume when it comes to lenders. A robust Item 19 (Financial Performance Representation) backed by solid historical data doesn’t just meet compliance requirements – it becomes a powerful tool that can significantly speed up financing approvals for your candidates. Lenders scrutinize this data to assess the financial viability of your franchise units, so transparency and accuracy here pay dividends.

Your proven business model is equally crucial. Lenders aren’t just funding a business; they’re investing in a system with demonstrated unit economics and consistent performance across different markets. When you can show how your concept generates revenue and profits regardless of location or market conditions, you’re speaking the lender’s language.

Comprehensive training and ongoing support round out the picture. Lenders want assurance that your franchisees aren’t just buying a name – they’re investing in a complete system designed for success. Your commitment to operational excellence, marketing support, and financial management guidance reduces perceived risk. A detailed Franchise Operations Manual that outlines best practices and standard procedures becomes another confidence builder for lenders.

Building a strong network of preferred lenders can be a game-changer. While only about 12% of franchisors offer in-house financing, many successful brands cultivate relationships with financial institutions that already understand their business model. These lenders have streamlined processes and can offer warm introductions for your candidates. Some franchisors sweeten the deal with incentives like deferred franchise fees or equipment leasing programs, further reducing upfront financial pressure.

Guiding Candidates Through the Funding Gauntlet

Let’s be honest – even with the most financing-friendly system, securing capital can feel overwhelming for candidates. This is where our guidance becomes invaluable, especially considering that 17% of franchisees cite lack of capital and cash flow as their biggest challenge.

Business plan assistance is where we can make an immediate impact. Lenders want to see exactly how borrowed money will be used and how it will generate returns. A well-researched business plan for a franchise with an established track record significantly increases funding approval odds. We can provide templates, review their plans, and connect them with expert consultants when needed.

Credit score education is equally important. Most lenders require a minimum credit score of 600 for business loans, with 640 recommended for SBA loans, and 700+ opening the most options with the best terms. We can advise candidates on maintaining strong personal credit profiles and help them understand that lenders typically expect 10% to 30% cash for initial investment.

Documentation preparation can make or break a financing application. Lenders need credit history, personal financial statements detailing income, assets, and debts, plus that robust business plan we mentioned. We can provide checklists and ensure candidates have everything organized before they approach lenders.

Setting realistic expectations about the process helps build trust and confidence. Even candidates with less-than-perfect credit have options, though they may come with higher costs. By encouraging candidates to ask better questions, negotiate terms thoughtfully, and partner with advisors early, we’re fostering the proactive mindset that leads to long-term success. This comprehensive support approach is exactly how we Transform Leads into Loyal Franchisees with a Proven Sales Strategy.

Frequently Asked Questions about Franchise Financing Trends

As we guide business owners through the franchising journey, certain questions about franchise financing trends come up repeatedly. These concerns reflect the real challenges you’ll face when building a financially strong franchise network. Let me address the most pressing ones based on my experience helping hundreds of franchisors steer this complex landscape.

How can we make our franchise brand more attractive to lenders?

Think of lenders as cautious investors who need concrete proof your franchise system works. They’re not just looking at your brand’s potential—they want hard data that shows consistent profitability across multiple locations.

The foundation starts with your FDD, particularly a compelling Item 19 that showcases real financial performance. Lenders dive deep into these numbers, analyzing unit economics, same-store sales growth, and profit margins. If your existing locations are thriving, make sure those success stories shine through in your documentation.

Beyond the paperwork, demonstrate that you’re building a proven business model with comprehensive training and ongoing support systems. Lenders feel more confident knowing your franchisees aren’t just buying a name—they’re getting a complete system designed for success.

Building relationships with preferred lenders who understand your industry can be a game-changer. These financial partners already know your business model and can streamline the approval process for your candidates. Some franchisors even offer confirmation emails to lenders, affirming that no modifications have been made to their franchise agreements, which provides the certainty lenders crave.

What is the most significant of the franchise financing trends for a new franchisor to understand?

The biggest shift that catches new franchisors off guard is the SBA’s elimination of its Franchise Directory in 2023. This change fundamentally altered how lenders evaluate franchise eligibility for SBA loans.

Previously, being listed in the SBA Franchise Directory was like having a stamp of approval—lenders could quickly verify that your franchise qualified for SBA financing. Now, each lender must independently determine whether your franchise system meets SBA requirements. This means more scrutiny, potentially longer approval times, and higher rejection rates if your documentation isn’t pristine.

For new franchisors, this franchise financing trend makes it absolutely critical to have your house in order from day one. Your franchise system needs to be transparent, well-documented, and clearly compliant with SBA guidelines. You can’t afford to have gaps in your documentation or unclear policies that might raise red flags during a lender’s due diligence process.

The silver lining? Franchisors who invest in solid systems and clear documentation from the start often find their candidates get approved faster than those with weaker foundations.

What role does our Franchise Disclosure Document (FDD) play in a candidate’s financing application?

Your FDD is essentially your franchise system’s resume when it comes to financing. Lenders treat it as their primary due diligence tool, and they scrutinize every detail to assess the risk of lending to your candidates.

The Financial Performance Representation in Item 19 carries enormous weight. This section provides the historical financial data that lenders use to evaluate whether a new franchise location is likely to generate enough cash flow to repay the loan. Strong, consistent performance numbers across multiple locations can significantly speed up approvals and potentially secure better loan terms for your candidates.

But lenders look beyond just the numbers. They examine your franchise agreement terms, your support systems, your litigation history, and your overall business model stability. A clear, comprehensive, and compliant FDD builds lender confidence in your entire system.

On the flip side, a weak or incomplete FDD raises immediate red flags. Missing financial data, unclear terms, or signs of system instability can lead to delays, additional requirements, or outright denials for your candidates’ loan applications.

The key is ensuring your FDD tells a compelling story of a stable, profitable franchise system that sets franchisees up for success. For guidance on maintaining compliance across different states, check out our Franchise Registration States Guide.

Conclusion: Turning Trends into Your Competitive Advantage

The franchise financing trends reshaping 2025 present an incredible opportunity for business owners ready to scale their concepts through franchising. What we’re witnessing isn’t just change—it’s evolution toward a more sophisticated, accessible financing ecosystem that rewards well-prepared franchisors.

Think about it: interest rate stabilization is making expansion more affordable for your future franchisees. The SBA’s continued fee waivers are putting thousands of dollars back in their pockets. Fintech solutions are cutting approval times from weeks to days. These aren’t just trends—they’re competitive advantages waiting to be leveraged.

But here’s what I’ve learned after helping hundreds of business owners steer franchise development: the brands that thrive aren’t just riding these waves—they’re building financing-friendly systems from the ground up. They’re creating robust FDDs with compelling Item 19 data. They’re establishing preferred lender relationships before they need them. They’re proactively educating their candidates about everything from ROBS strategies to multi-unit financing options.

The franchisors who struggle? They’re still thinking like traditional business owners, not franchise system builders. They’re reactive instead of strategic. They treat financing as their candidates’ problem rather than their competitive differentiator.

At Franchise Genesis, we’ve seen how understanding these franchise financing trends transforms not just individual deals, but entire franchise networks. When you build a system that makes it easier for qualified candidates to secure capital, you’re not just selling franchises—you’re building a sustainable network of successful business owners.

The landscape is shifting, and that shift creates opportunity. The question isn’t whether these trends will impact your franchise development—it’s whether you’ll use them to build the thriving network you envision.