Powering Your Franchise Network: Understanding Franchise Acquisition Financing

As you build your franchise system, understanding how your future franchisees will secure franchise acquisition financing is key. This knowledge helps you attract the right candidates and set them up for success.

For your prospective franchisees, here are the primary financing options they’ll typically explore:

- Government-Backed Programs: Like the Canada Small Business Financing Program (CSBFP) or SBA loans, which share risk with lenders, making loans more accessible.

- Traditional Bank Loans: These include term loans, lines of credit, and equipment financing from conventional banks.

- Personal Funds: Many franchisees use their own savings, retirement accounts (like RRSPs or TFSAs), or even home equity.

- Franchisor Financing: Some franchisors offer direct loans, deferred payments, or partner with specific lenders to help.

- Angel Investors & Family/Friends: Private capital from individuals who believe in the franchisee or the brand.

- Online Lending Marketplaces: Digital platforms that can provide faster access to funds, though terms may vary.

Building a successful franchise system lets you achieve your entrepreneurial dream while empowering others to achieve theirs. It’s about creating a network where everyone thrives.

My name is Monique Pelle-Kunkle, and as Vice President of Operations at Franchise Genesis, I specialize in guiding business owners through the complexities of franchising, including strategic approaches to franchise acquisition financing for their future network. My goal is to ensure your brand is set up for long-term success, helping female entrepreneurs, and all founders, scale effectively.

Understanding the Landscape of Franchisee Funding Options

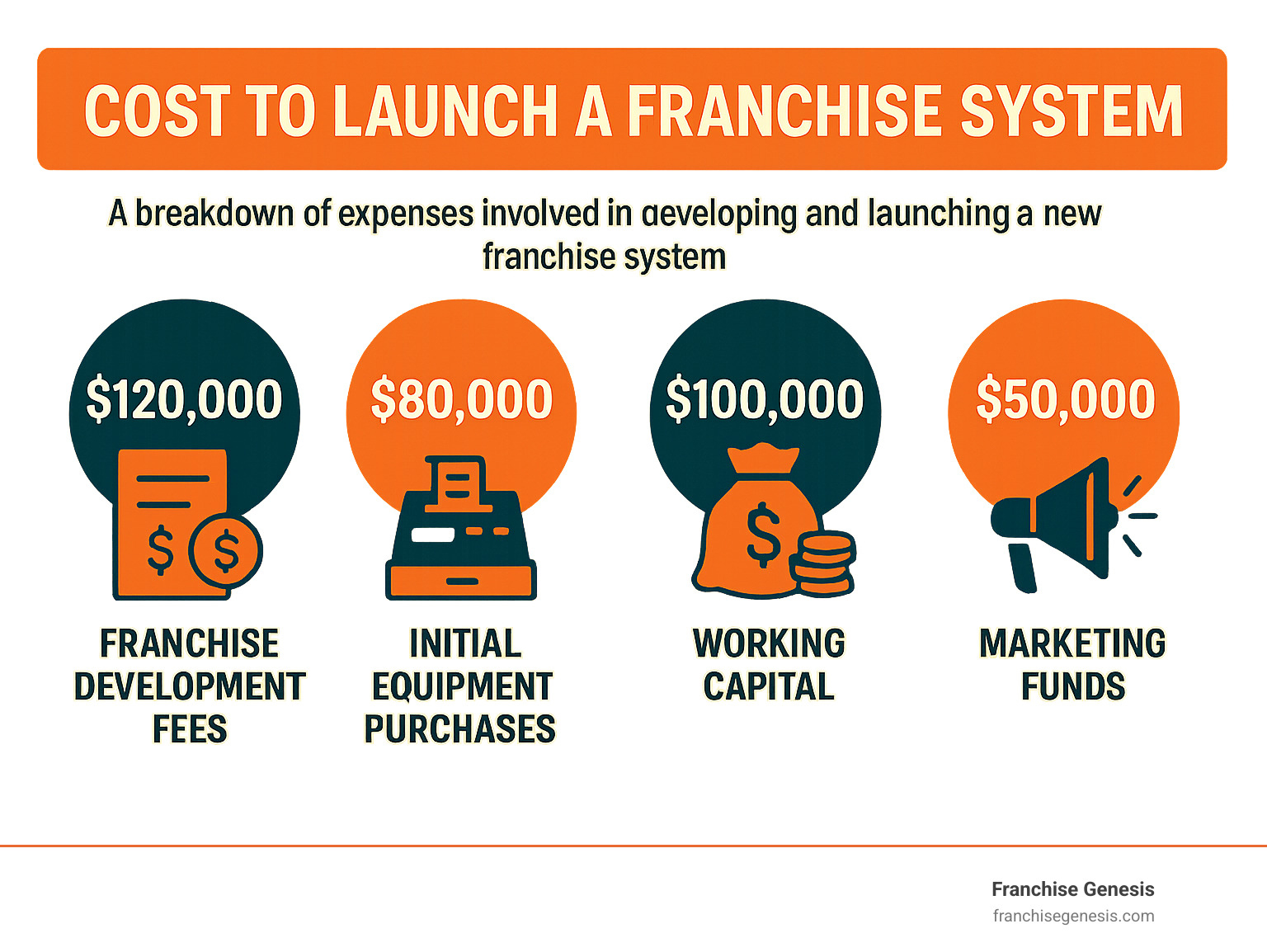

Building a franchise system requires understanding the financial journey your future franchisees will undertake. The easier it is for them to secure franchise acquisition financing, the more qualified candidates you’ll attract and the faster your network will grow. The average franchise launch can cost around $350,000, covering the franchise fee, real estate, equipment, inventory, and crucial working capital. Understanding the funding avenues available allows you to guide candidates effectively, preparing them to confidently approach lenders.

Let’s explore the main types of financing your prospective franchisees will encounter:

Traditional Bank & Lender Options

Conventional bank loans are the backbone of franchise acquisition financing. We help your franchisees understand these options to find the best fit.

- Term Loans: Ideal for significant, one-time costs like acquiring a location or major renovations. They offer stable, lower interest rates but can be harder for new businesses to secure and often require a larger down payment and a solid business plan.

- Lines of Credit: Essential for managing day-to-day cash flow. They provide flexible access to funds up to a set limit, protecting working capital during the crucial first few months.

- Equipment Financing: Allows franchisees to purchase necessary machinery without a large upfront cost. The equipment itself often serves as collateral, simplifying the approval process.

- Commercial Real Estate Loans: Long-term, fixed-rate financing specifically for purchasing commercial property.

- Home Equity Line of Credit (HELOC): Uses the franchisee’s home as collateral. While this can offer lower interest rates, it ties personal assets to the business, which is a significant risk we advise caution against.

| Feature | Government-Backed Programs (e.g., CSBFP, SBA Loans) | Conventional Bank Loans |

|---|---|---|

| Risk Sharing | Government guarantees a portion of the loan, reducing risk for lenders and making them more willing to approve. | Lender bears full risk, often requiring stronger borrower profiles and more collateral. |

| Accessibility | Easier for startups or businesses with less-than-ideal credit due to government backing. | Can be harder for startups to secure without a proven financial track record. |

| Loan Purpose | CSBFP: Equipment, leasehold improvements, real estate. SBA 7(a): General business purposes (working capital, equipment, real estate). SBA 504: Major fixed assets (real estate, machinery). | General business purposes, custom to specific needs (e.g., term loans for acquisition, lines of credit for working capital). |

| Loan Amounts | SBA 7(a): Up to $5 million. SBA 504: Up to $5 million. CSBFP: Up to $1 million. | Varies widely by lender and borrower’s creditworthiness; typically no fixed maximum. |

| Terms | SBA 7(a): Up to 10 years for working capital, 25 years for fixed assets. SBA 504: Up to 25 years. CSBFP: Up to 10 years. | Typically shorter (e.g., 15-20 years for fixed assets), leading to higher monthly payments. |

| Down Payment | Often lower (e.g., 10-15% for SBA 7(a), 20% for existing franchise transfers, 25-30% for new startups). | Can require larger down payments, especially for startups. |

| Interest Rates | Competitive, often lower due to government guarantee. | Can be competitive, but may be higher for riskier borrowers. |

| Fees | May include guaranty fees (e.g., SBA guaranty fee). | Origination fees, closing costs. |

| Collateral | May require personal guarantee and/or specific assets as collateral. | Typically requires collateral and personal guarantees. |

| Approval Speed | Can be perceived as slower, though Preferred Lender status can expedite. | Varies, but often faster for established businesses with strong financials. |

Personal and Private Funding Sources

A franchisee’s own network can be a quick path to franchise acquisition financing, but understand the risks.

- Personal Savings: The simplest method, avoiding interest and fees. However, it ties up personal cash, so franchisees should always maintain a separate emergency fund.

- Retirement Funds: A complex option using accounts like RRSPs/TFSAs or 401(k)s/IRAs. Programs like “Rollovers for Business Startups” (ROBS) in the US allow for tax-advantaged business funding, but if the business fails, retirement savings are at risk. This requires professional guidance.

- Loans from Friends and Family: Offers flexible terms but can strain relationships. A formal loan agreement detailing the amount, interest, and repayment schedule is essential to prevent future misunderstandings.

- Private Investors (Angel Investors): Wealthy individuals who provide capital in exchange for equity. They can be valuable partners with industry connections but are often the most expensive source of capital long-term. Business accelerators are a good place to find them.

We help our franchisees explore all these options, giving them the information they need to make smart choices that align with their personal financial comfort. For more in-depth guidance on leveraging personal resources for your business, check out our comprehensive resources at Franchise Your Business.

The Rise of Online Lending

Online lending platforms have become a major player in franchise acquisition financing, connecting franchisees with a vast network of lenders. The primary benefit is speed and convenience, with applications completed quickly and funds sometimes available within 24 hours. However, this accessibility can come with higher interest rates and shorter repayment terms. It’s crucial for franchisees to scrutinize all terms and fees to ensure the loan aligns with their business plan and cash flow projections. We guide franchisees in evaluating these platforms to find an option that supports their long-term success. Find how our services can simplify this process for your franchisees at Services for Franchisors and Franchisees.

How Lenders Evaluate Your Franchisees (And Your Brand)

As a franchisor, understanding how lenders assess risk is paramount. Their evaluation covers both your prospective franchisee and your brand’s stability and business model. By helping franchisees prepare and building a finance-friendly brand, you boost the odds of successful franchise acquisition financing for your network. Lenders perform due diligence on personal financials, credit reports, and your Franchise Disclosure Document (FDD), making your role in providing accurate information vital.

The 5 Cs of Credit in Franchising

The “5 Cs of Credit” are the criteria lenders use to evaluate loan applicants. For franchise acquisition financing, both your franchisee and your brand are under review:

- Character: The franchisee’s reliability, assessed via their credit history. Lenders look for strong credit scores (640+ recommended for SBA loans, 700+ for best terms). Encourage candidates to review their reports from Equifax or TransUnion.

- Capacity: The ability to repay the loan, determined by cash flow and projected earnings. A solid business plan is essential to demonstrate a clear path to profitability.

- Capital: The franchisee’s personal investment, typically 10% to 30% of the total cost. This ‘skin in the game’ shows commitment and reduces the lender’s risk.

- Conditions: The economic environment, industry trends, and loan purpose. Your brand’s market analysis and resilience directly strengthen this “C.”

- Collateral: Assets pledged as security for the loan, such as equipment, real estate, or even personal assets like a home. We help franchisees understand these requirements.

By understanding these “5 Cs,” you can better prepare your franchisees and refine your own brand’s financial presentation. Dive deeper into how these principles apply to building a thriving franchise network at Franchising Insights.

Essential Documentation Lenders Require

Securing franchise acquisition financing is a document-heavy process. Guiding your franchisees through this paperwork is a significant value-add. Key documents include:

- Resume and personal background.

- Personal financial statements (last year).

- Personal tax returns (previous three years).

- A complete personal credit report.

- A comprehensive business plan (see below).

- The draft of the Franchise Agreement.

- Your Franchise Disclosure Document (FDD), which is invaluable to lenders for its financial performance representations (Item 19) and system health details.

By preparing your franchisees for these requirements and ensuring your own FDD is robust and transparent, you streamline the financing process. For detailed guidance on building essential operational documents like your FDD, explore our insights on the Franchise Operations Manual.

The Crucial Role of the Business Plan

A well-crafted business plan is the narrative that convinces lenders to invest. For franchise acquisition financing, it shows the franchisee understands the business and market. A comprehensive plan should include:

- Executive Summary: A concise overview of the plan and funding request.

- Company Description: Details about your franchise brand and its unique selling points.

- Market Analysis: Examination of the target market, competition, and growth opportunities.

- Management Structure: Information on the franchisee’s team and experience.

- Marketing and Sales Strategy: Plans to attract and retain customers.

- Financial Projections: Detailed startup costs, profit and loss statements, and cash flow forecasts for 3-5 years. This is key to demonstrating “Capacity.”

- Funding Request: A clear statement of the amount needed and its use.

Providing a template populated with data from your FDD can significantly boost your candidates’ chances of securing franchise acquisition financing.

Your Role in Streamlining Franchise Acquisition Financing

Your support as a franchisor is critical after the franchise agreement is signed. Actively helping franchisees through the franchise acquisition financing process is a strategic move that strengthens your brand and attracts better candidates. Making financing easier creates a “finance-friendly” reputation in the lending community, opening doors for future growth. Well-funded franchisees are more likely to succeed, benefiting your entire network.

Offering In-House or Franchisor-Supported Financing

While only about 12% of franchisors offer direct in-house financing for franchise acquisition financing, there are other effective ways to ease the burden.

- Direct Lending: Offers control and can accelerate growth, but it ties up your capital and puts you in the collections business.

- Partnering with Preferred Lenders: This is often the sweet spot. Building relationships with banks that understand your model can streamline approvals and lead to better terms for your franchisees.

- Structured Financing Programs: Consider offering deferred franchise fees or helping secure equipment financing through third-party relationships. These approaches show commitment without the financial risk of direct lending.

For insights on how experts recommend preparing for investor relationships, check out this resource: More info on how experts recommend preparing for investors.

Preparing Franchisees for the Franchise Acquisition Financing Process

Your guidance can transform the financing process from a hurdle into a confidence-building experience.

- Provide Business Plan Templates: Give franchisees a professional framework populated with your brand’s details and financial data from your FDD’s Item 19. This ensures consistency and professionalism.

- Share Performance Data Transparently: Encourage candidates to speak with existing franchisees about real-world sales and expenses to set realistic expectations.

- Offer Documentation Guidance: Create a clear checklist of required documents and offer to review drafts. This small time investment can prevent costly delays.

- Set Realistic Expectations: Be upfront about the total investment, including ongoing fees and the absolute necessity of sufficient working capital to cover operations until the business is profitable.

Building a Strong Reputation in the Lending Community

Your brand’s reputation with lenders is a critical asset.

- Positive Franchisee Validation: Lenders often call existing franchisees. When they hear success stories, your brand’s credibility soars. Conversely, franchisee defaults can create a negative reputation.

- Strong Brand Performance: Consistent system-wide growth, low failure rates, and healthy unit economics prove your business model works.

- High-Quality FDD: A clear, comprehensive, and transparent FDD demonstrates professionalism and builds lender confidence.

- Proactive Communication: Reach out to banks, educate them on your concept, and build relationships. Getting on a lender’s “preferred” list makes financing dramatically easier for your candidates.

Understanding how financial relationships intertwine with franchise success is crucial. Learn more about building a comprehensive approach at Understanding the Key to Building a Thriving Franchise Network.

Frequently Asked Questions about Franchise Acquisition Financing

As you start on your franchising journey, you’ll likely have questions about how financing affects your growing network. These are some of the most common concerns I hear from business owners who are ready to franchise their brand.

As a franchisor, why do I need to understand my franchisee’s financing options?

Understanding franchise acquisition financing makes you a better partner to your franchisees. It helps you attract qualified candidates, guide them through a complex process, and build relationships with lenders who trust your brand. Most importantly, it reduces the risk of franchisee failure due to undercapitalization, strengthening your entire network.

What is the most common reason franchisees are denied loans?

The most common reasons are a weak business plan that fails to show a clear path to repayment, insufficient personal capital or collateral (lenders want to see “skin in the game”), and a poor personal credit history. Sometimes, the issue is the lender’s lack of confidence in the franchise brand itself. As a franchisor, you can mitigate these issues by providing strong brand data and helping candidates prepare compelling loan applications.

How much working capital should my franchisees have after the acquisition?

Insufficient working capital is a primary reason new franchises fail. While the exact amount varies, franchisees should have enough to cover all operating expenses for at least 6-12 months without relying on initial revenue. This safety net covers payroll, rent, inventory, marketing, and unexpected costs. Your Franchise Disclosure Document should provide a reasonable estimate for working capital needs in Item 7 (Estimated Initial Investment). Being transparent about these costs sets everyone up for success.

Conclusion

Navigating franchise acquisition financing might feel a bit like learning a new language, especially when you’re focused on building your amazing franchise system. But here’s a secret: your understanding and support in this area are absolute game-changers.

By truly grasping the different funding options available to your future franchisees, you’re doing more than just helping them get a loan. You’re setting them up for genuine success from day one. This means guiding them through the paperwork, helping them craft a business plan that sings, and proactively building a fantastic reputation for your brand within the lending community.

Think of it as laying a super strong foundation for your entire franchise network. When your franchisees are financially solid, they can focus on what they do best: running their business and making your brand shine. This isn’t just about their success; it’s about the collective strength and incredible growth of your entire system.

At Franchise Genesis, we’re passionate about helping you achieve this. We bring the expertise and guidance you need to ensure your financial strategies attract the very best talent and truly fuel your network’s expansion.

Ready to empower your franchisees and accelerate your brand’s growth? Let’s chat about building a financially sound foundation for your franchise system that sets everyone up to win. Get expert guidance on setting up your franchisees for financial success.