Why Understanding Franchise Loan Rates Matters for Growing Brands

Franchise loan rates directly impact your ability to attract qualified candidates and scale your brand successfully. When prospective franchisees can secure affordable financing, your franchise system grows faster and stronger.

Current Franchise Loan Rate Ranges:

- SBA 7(a) loans: 5.5% to 11.25%

- Traditional bank loans: 2% to 13%

- Online lenders: 7% to 100%

- Canada Small Business Financing: Prime + 3%

Interest rates can range from 5% to 12% depending on the loan type, with SBA loans typically offering the most competitive terms. The WSJ prime rate currently sits at 7.5%, serving as a baseline for many variable-rate loans.

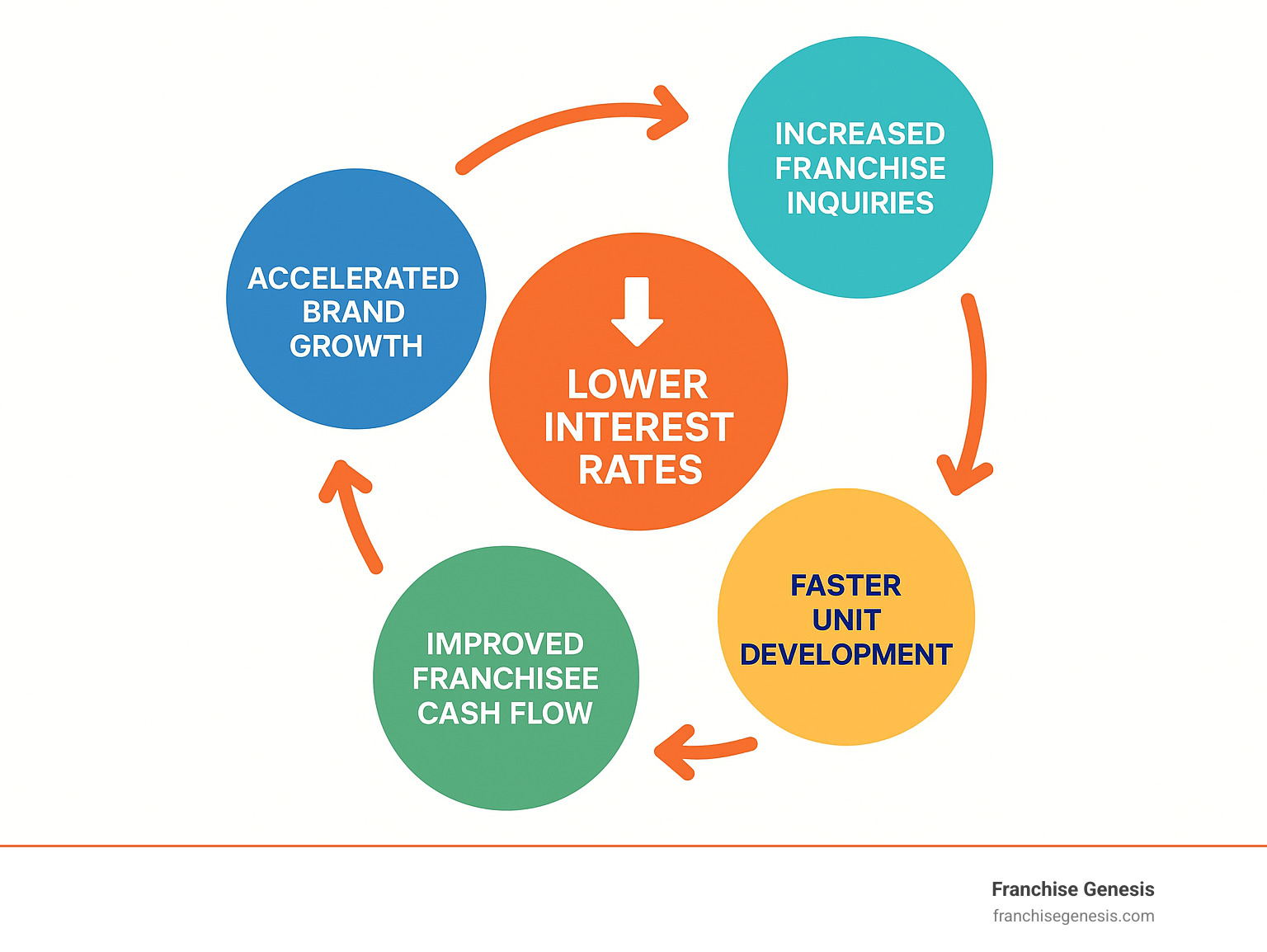

Lower interest rates create a ripple effect throughout your franchise system. When financing becomes more accessible, you’ll see increased inquiries from qualified candidates, faster unit development, and stronger cash flow for your franchisees. Recent Federal Reserve rate adjustments have already begun impacting franchise financing, with many in the industry reporting that interest rates affected their business decisions.

As Vice President of Operations at Franchise Genesis, I’ve guided numerous brands through the complexities of franchise loan rates and their impact on growth strategies. My experience scaling franchises across multiple markets has shown me how crucial it is for franchisors to understand the financing landscape their candidates face.

Understanding the Current Landscape of Franchise Loan Rates

Picture this: your perfect franchisee candidate walks into a lender’s office, excited about joining your brand. But when they hear about interest rates, their enthusiasm deflates faster than a punctured balloon. As a franchisor, understanding the financing landscape your potential franchisees face isn’t just helpful—it’s essential for your growth strategy.

Franchise loan rates typically range from 5% to 12%, but this broad spectrum tells only part of the story. The WSJ Prime Rate, currently sitting at 7.5%, serves as the foundation for many variable-rate loans. Think of it as the baseline that everything else builds upon.

Several economic factors shape these rates. When the Federal Reserve adjusts interest rates, the ripple effect reaches your potential franchisees’ wallets. Inflation pressures, market conditions, and overall economic health all play their part in determining what your candidates will actually pay for financing.

The landscape includes several distinct loan types, each with its own personality and quirks. Understanding these options helps you guide your franchisees toward the financing that makes the most sense for their situation and your brand’s growth goals.

For a comprehensive look at business loan rates across all industries, What Is the Average Interest Rate on a Business Loan? provides excellent context.

Typical Interest Rates by Loan Type

When your potential franchisees shop for financing, they’ll encounter three main categories of lenders, each offering different advantages and challenges.

SBA 7(a) loans represent the gold standard for franchise financing, with rates typically ranging from 5.5% to 11.25%. These government-backed loans reduce risk for lenders, which translates to better terms for your franchisees. The longer repayment periods—often 10 to 25 years—mean lower monthly payments, giving your franchisees more breathing room in their cash flow. This stability benefits your entire system.

Conventional bank loans offer the widest rate range, from 2% to 13%, depending on the borrower’s creditworthiness and the bank’s appetite for risk. While they can provide the lowest rates for well-qualified candidates, they often require more documentation and have stricter approval criteria. These loans work best for franchisees with strong credit scores and substantial down payments.

Online lenders fill the gap for speed and convenience, though their rates can range dramatically from 7% to 100%. They’re the fast food of business lending—quick but often more expensive. For franchisees who need funding quickly or don’t qualify for traditional financing, online lenders provide an important safety net.

| Loan Type | Average Rate Range | Typical Term Length | Ideal Use for a Franchisee |

|---|---|---|---|

| SBA 7(a) Loans | 5.5% – 11.25% | 10-25 years | Working capital, equipment, real estate, business acquisition |

| Conventional Bank Loans | 2% – 13% | 1-10 years | Established businesses, large purchases, general capital needs |

| Online Lenders | 7% – 100% | 6 months – 5 years | Quick funding for urgent needs, smaller amounts, less stringent criteria |

Fixed vs. Variable Franchise Loan Rates

The choice between fixed and variable rates can significantly impact your franchisees’ long-term success—and by extension, your brand’s stability.

Fixed-rate loans offer the comfort of predictability. Your franchisees know exactly what they’ll pay each month for the entire loan term. This consistency makes budgeting easier and reduces financial stress, especially during the critical early months of operation. When your franchisees can predict their costs, they can focus on building their business rather than worrying about fluctuating payments.

Variable-rate loans dance to the rhythm of market conditions, typically tied to the WSJ Prime Rate. While they might start with attractively low rates, they carry the risk of increases over time. Most SBA loans reset quarterly, which means your franchisees could see their payments change four times a year.

The choice between fixed and variable rates often comes down to risk tolerance and market outlook. If rates are expected to fall, variable rates might save money. But if your franchisees prefer stability and predictable cash flow, fixed rates provide peace of mind.

The financing landscape your franchisees steer directly impacts your ability to grow. When you understand these options, you can better prepare your candidates for success and build a stronger, more resilient franchise system.

Key Factors That Influence Franchise Loan Rates

When lenders set franchise loan rates, they’re not just throwing darts at a board. They’re carefully weighing multiple factors to determine how risky it would be to lend money to your potential franchisees. The good news? As a franchisor, you have more influence over these factors than you might think.

Lenders examine your franchisee candidates like detectives solving a case. They’ll scrutinize the borrower’s credit score – both personal and business – because it tells the story of how responsibly someone has handled money in the past. A candidate with a 750 credit score will almost certainly get better rates than someone with a 620.

The type and value of collateral your franchisee can offer also plays a huge role. Real estate tends to be the gold standard here, but equipment and other business assets can work too. Think of collateral as the lender’s safety net – the better the net, the more comfortable they feel offering lower rates.

Down payment size is another critical piece. When your franchisee puts more skin in the game upfront, lenders see it as a sign of commitment and reduced risk. A 20% down payment typically opens doors to better franchise loan rates than a 10% down payment.

The quality of the business plan your franchisee presents can make or break their application. A well-researched, comprehensive plan that clearly shows how they’ll generate revenue and repay the loan is like music to a lender’s ears. Finally, the loan term itself affects rates – shorter terms usually mean lower rates, but higher monthly payments.

For more insights into how these factors tie into successful franchising strategies, explore our Franchising Insights.

The Franchisor’s Role in Securing Favorable Rates

Here’s where things get exciting – you’re not just a bystander in your franchisees’ financing journey. Your brand reputation carries serious weight with lenders. When your franchise system has a solid track record of successful locations and satisfied franchisees, lenders take notice. They’re much more likely to offer competitive franchise loan rates to candidates joining a proven winner.

Your proven business model is like a roadmap that shows lenders exactly how your franchisees will succeed. When you can demonstrate consistent performance across multiple locations, with detailed financial projections and operational systems, you’re essentially de-risking the investment for lenders. This is where having a comprehensive Franchise Operations Manual becomes invaluable – it shows lenders that your franchisees won’t be flying blind.

Building franchisor-lender relationships is one of the smartest moves you can make. When you develop partnerships with lenders who understand your business model inside and out, they can fast-track applications and often offer better terms. These preferred lenders already know your success rates, your support systems, and your market positioning.

Getting listed on the SBA Franchise Directory is like getting a seal of approval from the government. This listing tells lenders that the SBA has reviewed your franchise system and considers it eligible for their loan programs. Navigating this process can significantly improve your franchisees’ access to favorable financing.

How Economic Conditions Affect Lending

The economic climate affects franchise loan rates like weather affects your daily plans – you can’t control it, but you definitely need to pay attention to it. Federal Reserve policy is the big kahuna here. When the Fed adjusts the federal funds rate, it creates ripple effects throughout the entire lending landscape. Lower federal rates typically mean better borrowing conditions for your franchisees.

Inflation impact is another major player. When inflation runs hot, the Fed often raises rates to cool things down, making loans more expensive across the board. But when inflation is under control, rates tend to be more favorable. It’s a delicate balancing act that affects every business owner looking to expand.

Market trends and competition among lenders can work in your favor too. When banks are competing for business, they might offer more attractive rates or easier qualification requirements. We’ve seen periods where lenders were practically fighting over quality franchise deals, leading to some fantastic financing opportunities.

Understanding these economic patterns helps you time your expansion strategies more effectively. When rates are favorable, it might be the perfect moment to ramp up your franchise development efforts. When they’re higher, you might focus more on supporting existing franchisees or preparing for better conditions ahead.

Strategic timing isn’t just about luck – it’s about understanding these economic cycles and positioning your franchise system to take advantage of favorable conditions. For more insights on timing your growth effectively, check out our Franchise Growth Strategies.

The Strategic Advantage of Government-Backed Loan Programs

When you’re building a franchise system, one of your biggest challenges is helping qualified candidates secure affordable financing. This is where government-backed loan programs, particularly those from the Small Business Administration (SBA), become your secret weapon. These programs aren’t just another financing option – they’re the backbone of successful franchise expansion.

Think of SBA loans as a bridge between cautious lenders and ambitious franchisees. The government backing reduces lender risk dramatically, which creates a ripple effect of benefits for your potential franchisees. They’ll typically see more competitive franchise loan rates, longer repayment periods that ease cash flow pressure, and often lighter collateral requirements that make qualifying easier.

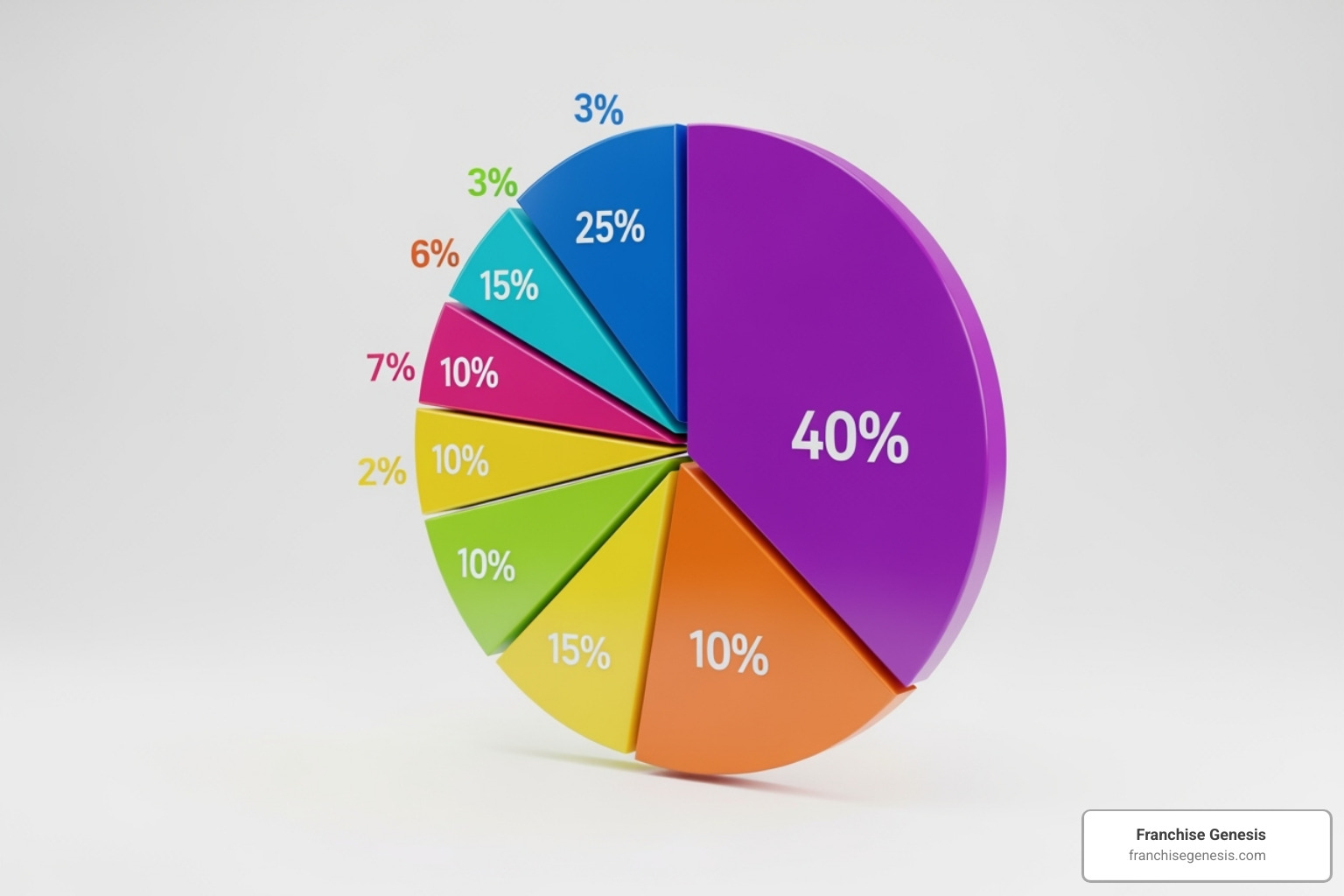

Here’s a telling statistic: about 10% of all SBA loans go to franchises. This isn’t random – it reflects how well-established franchise business models align with the SBA’s mission to support sustainable small business growth. When lenders see a proven franchise system, they’re naturally more confident about approving loans.

Navigating SBA 7(a) and 504 Loans for Your Franchisees

Your potential franchisees will encounter two main SBA programs, each designed for different needs. Understanding these programs helps you guide candidates toward the right financing solution.

The SBA 7(a) Loan Program is the workhorse of franchise financing. It’s incredibly versatile, covering everything from working capital to equipment purchases to real estate acquisition. With loan amounts up to $5 million, it can handle most franchise investment levels. The beauty of 7(a) loans lies in their flexibility – whether your franchisee needs to buy equipment, lease improvements, or maintain working capital during the startup phase, this program likely covers it. You can explore more details at SBA’s 7(a) Loan Program.

The 504/CDC loan program takes a different approach, focusing specifically on major fixed assets like real estate and long-term equipment. This program offers long-term, fixed-rate financing that’s perfect for franchisees looking to purchase their location rather than lease. However, it comes with job creation requirements and can’t be used for working capital or inventory. The maximum amount reaches $5 million, making it ideal for larger franchise investments. Learn more about this specialized program at 504/CDC loan program.

Getting Your Brand on the SBA Franchise Directory

This is where your proactive efforts as a franchisor can directly impact your growth trajectory. Getting listed on the SBA Franchise Directory isn’t just a nice-to-have – it’s a strategic advantage that makes your franchise opportunity significantly more attractive to both lenders and candidates.

The approval process involves submitting your Franchise Disclosure Document (FDD) to the SBA for review. Once approved, your brand carries the implicit endorsement of having passed SBA scrutiny. This pre-approval creates a streamlined path for your franchisees’ loan applications, often resulting in faster approvals and better franchise loan rates.

From a lender’s perspective, SBA-approved franchises represent lower risk. They know the business model has been vetted, the financial projections are realistic, and the support system is robust. This confidence translates directly into more favorable financing terms for your candidates.

The credibility boost extends beyond just financing. When prospects see your brand is SBA-approved, it signals legitimacy and stability. This can be particularly valuable if you’re expanding into new markets where your brand recognition might be limited.

For franchisors operating across multiple states, understanding the broader regulatory landscape is crucial for smooth expansion. Our Franchise Registration States Guide provides essential insights into state-specific requirements that complement your SBA approval strategy.

How Franchisors Can Help Franchisees Secure Better Financing

Here’s the thing about being a successful franchisor – you’re not just in the business of selling franchise units. You’re in the business of creating success stories. And nothing sets your franchisees up for success quite like helping them secure the best possible financing from day one.

Your role in the financing process is absolutely crucial, and frankly, it’s one of the most overlooked aspects of franchise development. When you actively support your franchisees through their funding journey, you’re not just being helpful – you’re making your entire franchise opportunity more attractive to high-quality candidates.

Think about it from a prospective franchisee’s perspective. When they’re comparing franchise opportunities, the one that offers clear financing support and established lender relationships is going to stand out. It shows you’re invested in their success beyond just collecting franchise fees.

This proactive approach creates a ripple effect throughout your entire system. Better financing means stronger franchisees, which leads to better unit performance, which ultimately drives more growth for your brand. For more insights on how this ties into your overall growth strategy, check out our Franchise Sales & Marketing resources.

Developing a Network of Preferred Lenders

Building relationships with lenders might not be the most exciting part of franchise development, but it’s absolutely one of the most valuable things you can do for your franchisees. When you have a solid network of preferred lenders who understand your business model, everything becomes easier.

Vetting the right financial institutions is your first step. You want to find banks, credit unions, and specialized lenders who genuinely understand franchising – not just those who claim they do. Look for lenders who have successfully funded businesses in your industry and who show genuine enthusiasm for your brand specifically.

The magic happens when you start negotiating favorable terms for your franchisees. With a steady stream of qualified candidates and a proven business model, you have leverage. Lenders want good borrowers, and you can deliver them. This often translates into better franchise loan rates, reduced fees, or more flexible terms for your franchisees.

Streamlining the application process becomes much easier when lenders already know your system inside and out. They’re familiar with your Franchise Disclosure Document, they understand your typical unit economics, and they’ve seen your franchisees succeed before. This familiarity can cut weeks off the approval process.

I’ve seen franchisors reduce their candidates’ average loan approval time from 60 days to just 30 days simply by having strong lender relationships in place. That’s a month faster that your new franchisee can get their doors open and start generating revenue.

For reference on some of the top players in franchise lending, you might find this helpful: Top Lenders for Franchise Loans.

Strengthening Your Franchisee’s Loan Application

Even with the best lender relationships in the world, your franchisees still need to present strong loan applications. This is where your support can make the difference between approval and rejection.

Providing comprehensive business plan templates is one of the most practical ways you can help. Don’t just hand over a generic template – create one that’s specifically custom to your franchise model. Include your typical startup costs, realistic revenue projections based on existing unit performance, and clear explanations of how your system works.

Supporting financial projections goes beyond just providing numbers. Help your franchisees understand the story behind the numbers. When they can confidently explain to a lender why they expect to hit certain revenue milestones and how your system supports those projections, it builds tremendous credibility.

Demonstrating proven profitability is where your track record becomes invaluable. Share performance data from existing units (where legally permissible), highlight your brand’s growth trajectory, and showcase the strength of your ongoing support systems. Lenders want to see that your franchisees don’t just survive – they thrive.

Highlighting your support systems might be the most underestimated factor in loan approvals. Lenders know that franchisees with strong franchisor support are significantly more likely to succeed. Make sure they understand the depth of your training programs, your ongoing operational support, your marketing assistance, and your problem-solving resources.

When lenders see that your franchisees have access to comprehensive support, it dramatically reduces their perceived risk. A franchisee with your backing isn’t going it alone – they’re part of a proven system with built-in success factors.

For franchisees who want additional guidance on business planning, Consulting a SCORE Business Mentor can provide valuable supplementary support to what you’re already offering.

Conclusion

When you’re building a franchise brand, understanding franchise loan rates isn’t just something to leave to your future franchisees—it’s actually one of your most powerful strategic tools. Think about it: when qualified candidates can easily secure affordable financing, your brand grows faster and stronger. It’s that simple.

Throughout this guide, we’ve explored how franchise loan rates ranging from 5% to 12% can make or break a candidate’s decision to join your system. We’ve seen how SBA loans offer some of the most competitive terms, how your brand’s reputation directly impacts the rates your franchisees receive, and how building relationships with preferred lenders can streamline the entire funding process.

The beauty of understanding this landscape is that it puts you in the driver’s seat. When you get your brand listed on the SBA Franchise Directory, develop strong lender relationships, and provide comprehensive support to your candidates during the financing process, you’re not just helping individuals—you’re building a more accessible and attractive franchise opportunity.

Your role extends far beyond selling franchise units. By actively supporting your candidates through their financing journey, providing robust business plan templates, and demonstrating the proven profitability of your system, you create a win-win situation. Lenders see reduced risk, candidates get better rates, and your brand expands with financially stable franchisees.

At Franchise Genesis, we understand that building a fundable franchise brand requires expertise in every aspect of the franchising process—from operations manuals to lender relationships. We specialize in developing robust franchise systems that appeal to both high-quality candidates and the financial institutions that fund them.

Ready to build a franchise brand that candidates can easily fund and lenders love to support? Explore our comprehensive services for franchisors and franchisees and find how we can help you create a truly fundable franchise opportunity.