Understanding Franchise Financing Companies: Your Gateway to Successful Expansion

Franchise financing companies are specialized lenders that help franchisees secure capital. These companies understand the franchise model and offer custom funding solutions, including SBA loans, conventional bank loans, alternative financing, and equipment leasing.

Top Types of Franchise Financing Companies:

- SBA Preferred Lenders – Government-backed loans with lower down payments

- Alternative Online Lenders – Fast funding with flexible requirements

- Specialized Franchise Lenders – Industry experts with franchise-specific programs

- Equipment Financing Companies – Lease solutions for franchise equipment needs

- ROBS Providers – Help franchisees use retirement funds as startup capital

As a successful business owner transitioning to a franchisor, one of the most critical decisions you’ll make is how you support franchisee funding. Your role in this process can make or break your expansion strategy.

Entrepreneurs looking at your franchise opportunity aren’t just evaluating your brand—they’re figuring out how to pay for it. With startup costs ranging from $20,000 to over $1 million, and lenders requiring 10-30% in cash, this is a major hurdle.

This is where smart franchisors step in. By building relationships with franchise financing companies and creating a robust funding strategy, you remove the biggest barrier to growth, helping qualified candidates become successful franchisees faster.

As Monique Pelle Kunkle, Vice President of Operations at Franchise Genesis, I’ve seen how partnering with the right franchise financing companies accelerates growth and attracts higher-quality candidates. My experience scaling franchises has shown me that a solid funding strategy isn’t just about money—it’s about building sustainable success.

Why a Robust Financing Strategy is Your Key to Franchise Growth

Financing is the fuel for your franchise expansion. Without it, even promising candidates will struggle. By developing a strong financing strategy with franchise financing companies, you’re not just helping individuals—you’re building a foundation for explosive growth.

Attracting qualified candidates becomes easier when you remove financial barriers. Many talented entrepreneurs have the skills to run your franchise but lack the full capital upfront. Traditional banks often avoid lending to franchises they don’t understand. By partnering with specialized franchise financing companies that know your business model, you open doors for these high-quality candidates.

The impact on your sales cycle is dramatic. Instead of deals dragging on for months, you can help candidates secure capital quickly. Faster funding means franchisees start generating revenue sooner, which translates to royalty payments for you.

Proper financing also dramatically reduces franchisee failure rates. It’s not just about opening costs; it’s about having enough working capital to survive the crucial first months. A well-capitalized franchisee can weather challenges, invest in marketing, and build their customer base without cash flow stress.

This creates a positive ripple effect. Thriving franchisees improve your brand reputation, and success stories attract more qualified candidates. Your franchise becomes known for its comprehensive support, not just its business model.

In a competitive landscape, superior financing support is a significant competitive advantage. You become the franchisor who makes opportunities genuinely accessible, differentiating you from other brands.

Understanding financial requirements is crucial for setting realistic expectations. Most franchisors establish minimum net worth requirements and liquid capital thresholds. Lenders generally expect franchisees to contribute 10-30% of the total investment as a down payment.

By working with franchise financing companies, you can help your candidates prepare for these requirements in advance, preventing surprises and keeping deals moving smoothly.

A robust financing strategy is essential infrastructure for franchise growth. When you make funding accessible, you accelerate everything: candidate attraction, deal completion, franchisee success, and your own expansion goals.

For more insights into creating a thriving franchise network, we encourage you to read our guide: Understanding the key to building a thriving franchise network.

A Franchisor’s Guide to the Main Types of Franchisee Funding

Understanding the financing landscape is a roadmap for your franchise expansion. When you know the different funding options, you can guide candidates toward the best solutions, changing you from a business opportunity provider into a trusted advisor.

Let’s walk through the main funding avenues your future franchisees will explore and what you need to know to support them.

Small Business Administration (SBA) Loans

SBA loans are often the first choice for franchise candidates. These government-backed loans offer some of the most attractive terms available. The SBA guarantees a portion of the loan, giving banks confidence to approve candidates who might not otherwise qualify.

Candidates benefit from lower down payments (often 10%) and longer repayment terms (up to 25 years for fixed assets), which means better cash flow. For you as a franchisor, getting your brand listed in the SBA Franchise Directory is a stamp of approval. This credibility boost makes the entire process smoother for your candidates.

Two main types are the SBA 7(a) loans, which are flexible for working capital and equipment, and SBA 504 loans, which focus on major fixed assets. The main downside is the processing time, which is typically 30-60 business days.

Conventional Bank Loans

These are traditional lenders like banks and credit unions that offer loans without government backing. For franchisors with strong track records, these loans can be a great option, often providing favorable rates for strong candidates with excellent credit and collateral.

The challenge lies in their stricter requirements, typically demanding higher down payments and pristine credit histories. Your role is crucial here. Building banking relationships for your network can open doors for your candidates. Educating candidates on credit preparation is also a significant value-add.

Alternative Lenders & Online Financing

The digital lending revolution offers faster funding and more flexible requirements. Some online lenders can fund applications within 24 hours, filling gaps left by traditional banks. They are often more willing to work with candidates who have less-than-perfect credit.

This convenience usually comes with higher interest rates and shorter repayment terms. However, for the right situation, these factors are worthwhile. These lenders offer products like working capital loans and equipment financing, making them a good option for smaller initial investments or when quick capital is needed.

Rollovers for Business Startups (ROBS)

ROBS is a strategy that allows candidates to use retirement funds as startup capital without the usual penalties and taxes. Candidates invest their 401(k) or IRA funds into their new franchise by purchasing stock in a newly formed C-corporation. This creates debt-free capital, eliminating monthly loan payments during the critical early stages.

When done correctly, there are no taxes or penalties on the funds used. However, the complex setup requires expertise, as the IRS watches these plans carefully and mistakes can be costly. Partnering with specialized ROBS providers is essential to steer the complexities safely. ROBS can also serve as the equity injection required for an SBA loan, creating a powerful combination to maximize capital.

Understanding these options positions you to guide candidates effectively. When you are knowledgeable about franchise financing companies, you become a trusted advisor who makes business ownership dreams achievable.

How to Partner with Top Franchise Financing Companies

Think of yourself as a matchmaker connecting qualified candidates with the capital they need. As a franchisor, building relationships with top franchise financing companies is essential for smooth expansion.

When you create a preferred lender list, you build a network of financial partners who understand your brand and your candidates’ needs. This strategic approach transforms the financing process into a streamlined experience that accelerates your sales cycle.

Partnering with the right franchise financing companies allows you to create co-branded marketing materials and offer multiple funding programs under one roof. This is like having a financial concierge service built into your Franchise Sales & Marketing support strategy.

What to Look for in a Franchise Financing Partner

Not all lenders are created equal. When vetting partners, find companies that see the value in the franchise model and recognize that franchisees often have better success rates than independent startups.

Experience with your industry should be at the top of your checklist. A lender who has successfully funded quick-service restaurants might not understand the unique needs of a home services franchise. The best partners specialize in franchising and speak its language fluently.

Understanding of the franchise model is key. The best financing partners recognize the stability that comes with your proven business system, ongoing support, and established brand recognition.

Nationwide lending capability is crucial if you’re planning to expand beyond your local market. Look for partners who can serve candidates wherever your expansion dreams take you.

Responsiveness and support can make or break a deal. The financing process is often stressful, so you want partners who provide clear communication and dedicated loan specialists. Their responsiveness reflects well on your brand.

Positive testimonials and a proven track record speak volumes. Look for partners with years of experience and thousands of success stories.

A network of multiple lenders can significantly increase approval chances. Some franchise financing companies act as brokers, working with dozens of lenders. This approach means if one lender says no, there are still other options to explore.

Creating a Turnkey Solution for Your Candidates

Your goal is to make the financing process as smooth as possible. Creating a turnkey solution means removing friction at every step.

Pre-qualification tools give candidates immediate clarity. Simple online calculators provide instant estimates, setting realistic expectations from day one.

Dedicated loan specialists within your preferred lender network become invaluable resources. This personal touch transforms a bureaucratic process into a supportive experience.

Educational resources like guides and FAQs explain the process. Knowledge reduces anxiety, and confident candidates move through your sales process more quickly.

By streamlining the application process through these partnerships, you accelerate your entire franchise sales strategy. When financing feels manageable, qualified candidates move forward with confidence, bringing you closer to your expansion goals.

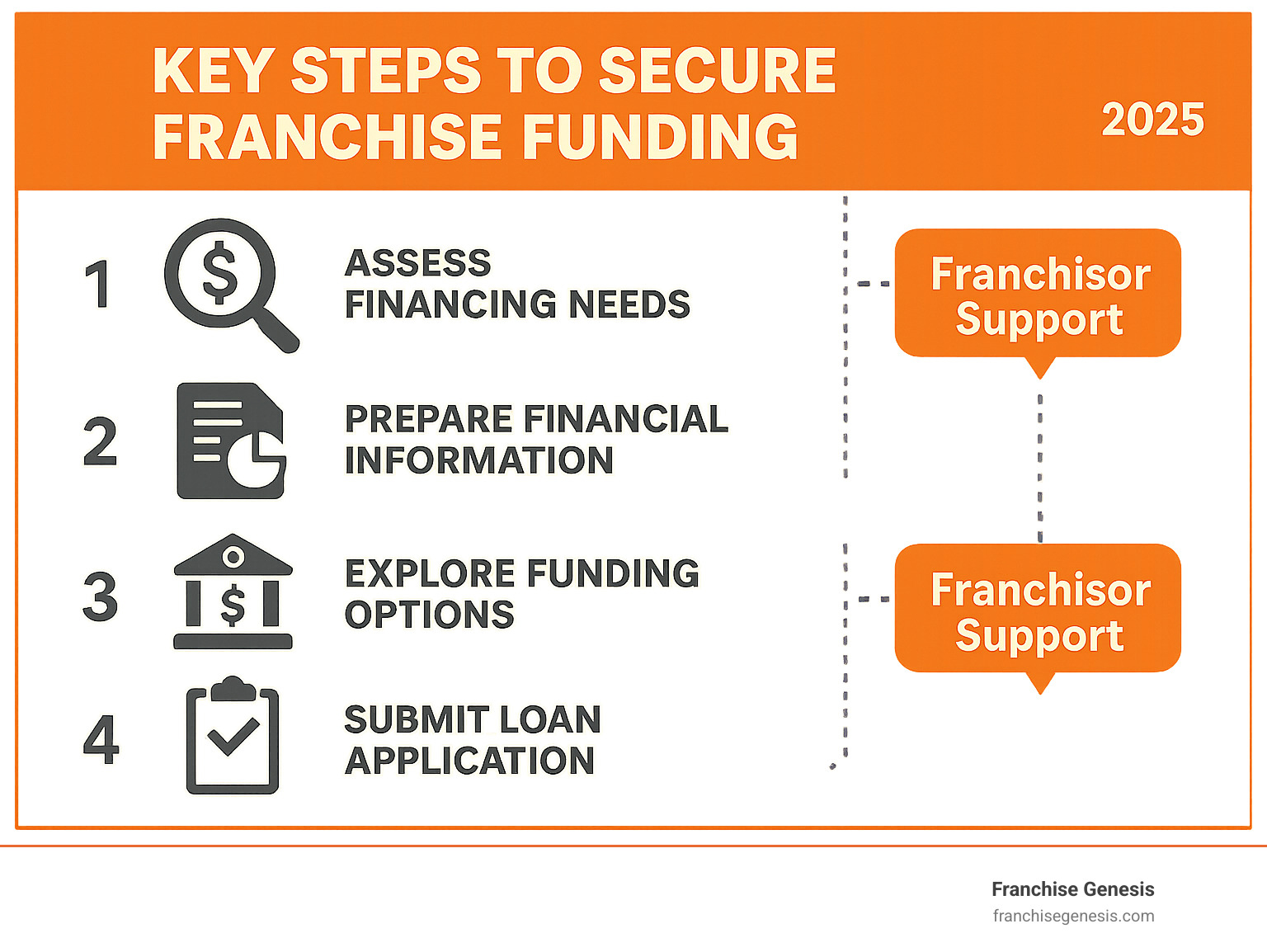

Empowering Your Candidates: The Path to Loan Approval

Your role as a franchisor extends to supporting candidates through the financing process. While you won’t co-sign loans, your active support can be the difference between denial and approval.

Think of yourself as the bridge between your candidate’s dreams and the lender’s requirements. Franchise financing companies want to see that you’re invested in your franchisees’ success, and there are concrete ways to demonstrate this.

Providing Key Documents is your first line of support. Your Franchise Disclosure Document (FDD) is your candidate’s credibility booster. Lenders will look for evidence that your franchise system is stable and well-managed. Make sure your FDD is comprehensive and current.

A powerful tool is your Financial Performance Representations (Item 19). Solid Item 19 data provides lenders with real numbers from your existing locations—average revenues, expenses, and profits. It transforms your franchise from an idea into a proven investment opportunity in the lender’s eyes.

Key Eligibility Requirements Lenders Scrutinize

Lenders will examine your candidates from every angle. Understanding what they’re looking for helps you guide the right people toward franchise ownership.

- Strong personal credit scores top every lender’s checklist. Most want to see a FICO score of 680 or higher, with 700+ opening doors to the best terms.

- Sufficient down payment requirements typically range from 10-30% of the total investment. This shows commitment and that the candidate has skin in the game.

- Positive net worth and liquid assets go beyond the down payment. Lenders want assurance that your candidate can weather the ups and downs of business ownership.

- Relevant industry or management experience can be a game-changer. Candidates with related experience or strong leadership backgrounds have a significant advantage.

- A comprehensive business plan serves as the roadmap for success, showcasing market analysis, operational strategies, and detailed financial projections.

- Clean financial history is non-negotiable. Recent bankruptcies or foreclosures are major red flags.

Helping Candidates Build a Strong Loan Application

This is where your expertise as a franchisor is invaluable. You can help candidates present your business model in the most compelling way.

Business plan templates customized to your franchise model can save candidates time while ensuring they hit all the right notes.

Financial projection guidance is where your Item 19 data shines. Help candidates create realistic forecasts that align with your system’s performance.

Your detailed Franchise Operations Manual plays an indirect but crucial role by demonstrating the strength and replicability of your system.

Connecting candidates with financial advisors who specialize in franchise financing can be incredibly valuable.

Setting realistic expectations might be the most important support you provide. The financing process takes time—often 30-60 days for SBA loans. Help candidates understand the timeline and prepare for challenges.

Every successfully funded franchisee validates your business model and makes the next approval easier. Your investment in supporting candidates pays dividends in faster growth and a stronger network.

Frequently Asked Questions about Franchise Financing for Franchisors

As you begin your franchising journey, questions about financing will arise. These concerns directly impact your growth strategy. Let me address the most common questions we hear from business owners ready to expand.

How much capital do my franchisees really need to get started?

The franchise fee is just the beginning. Your candidates need to understand the total initial investment, and you play a crucial role in clarifying this. The total investment includes leasehold improvements, equipment, inventory, marketing, and most critically, working capital.

Your Franchise Disclosure Document (FDD), specifically Item 7, details the estimated initial investment, which lenders will scrutinize. While some financing starts as low as $10,000, investments can easily exceed $1 million for certain concepts.

We always recommend building in a contingency fund. Encourage candidates to set aside at least 3-6 months of operating expenses. This cushion demonstrates prudence to lenders and gives new franchisees breathing room.

Can I, as the franchisor, offer direct financing to my franchisees?

Yes, and it can be a powerful competitive advantage. Major brands like 7-Eleven and The UPS Store offer direct financing.

The benefits are compelling: you can accelerate your sales cycle, control the terms, and attract a broader pool of candidates. However, this decision requires careful consideration. Offering direct financing ties up your own capital and means you assume the credit risk if a franchisee defaults.

Legal compliance adds another layer of complexity. Structuring a financing program requires experienced franchise attorneys, especially when operating in franchise registration states. We help franchisors evaluate if direct financing aligns with their goals, as partnering with franchise financing companies is often more strategic.

What are the most common reasons a franchisee’s loan application is denied?

Understanding common loan denial pitfalls helps you guide candidates proactively, increasing their chances of approval.

- Poor credit history is a top reason. Low credit scores signal financial irresponsibility to lenders.

- Insufficient down payment or collateral is another major hurdle. Most lenders require a significant cash injection (10-30%).

- A weak or incomplete business plan suggests a candidate isn’t ready for business ownership.

- Lack of relevant experience raises lender concerns, especially for first-time business owners.

- Problems with your brand’s history or SBA eligibility can also create obstacles. If your system has high failure rates or isn’t in the SBA Franchise Directory, candidates face challenges.

By understanding these reasons, you can better prepare your candidates for success. This proactive approach strengthens your entire system’s reputation with franchise financing companies.

Conclusion

The journey from successful business owner to thriving franchisor is one of the most rewarding paths an entrepreneur can take. We’ve seen how franchise financing companies are essential partners in your expansion strategy.

You’ve built an amazing business, and you’re ready to share that success. The crucial bridge between your proven concept and a national presence is helping qualified candidates secure the funding they need to join your system.

When you take a strategic approach to financing, you attract higher-quality candidates, accelerate your growth timeline, and build stronger franchisees who have the capital to thrive from day one.

The relationships you build with reputable franchise financing companies become one of your most valuable assets. These partnerships transform potential obstacles into competitive advantages.

Empowering candidates through the financing process—by providing a comprehensive FDD, business plan templates, and realistic expectations—demonstrates the support that defines top franchise systems. It shows you’re invested in their success, not just in collecting a fee.

At Franchise Genesis, we’ve seen how the right financing strategy can transform a good franchise concept into an unstoppable growth engine. We help you structure your system so that funding becomes a bridge to success rather than a barrier to entry. Because when your franchisees succeed, your entire network thrives.

Ready to turn your successful business into a franchise powerhouse? Explore our services for franchisors and franchisees and let’s build your expansion strategy together.