Why Understanding Franchise Startup Costs is Critical for Your Expansion Success

Franchise startup costs can make or break your expansion dreams. Whether you’re developing your franchise system or preparing to guide future franchisees, getting these numbers right is essential for sustainable growth.

Quick Answer: Franchise Startup Costs Overview

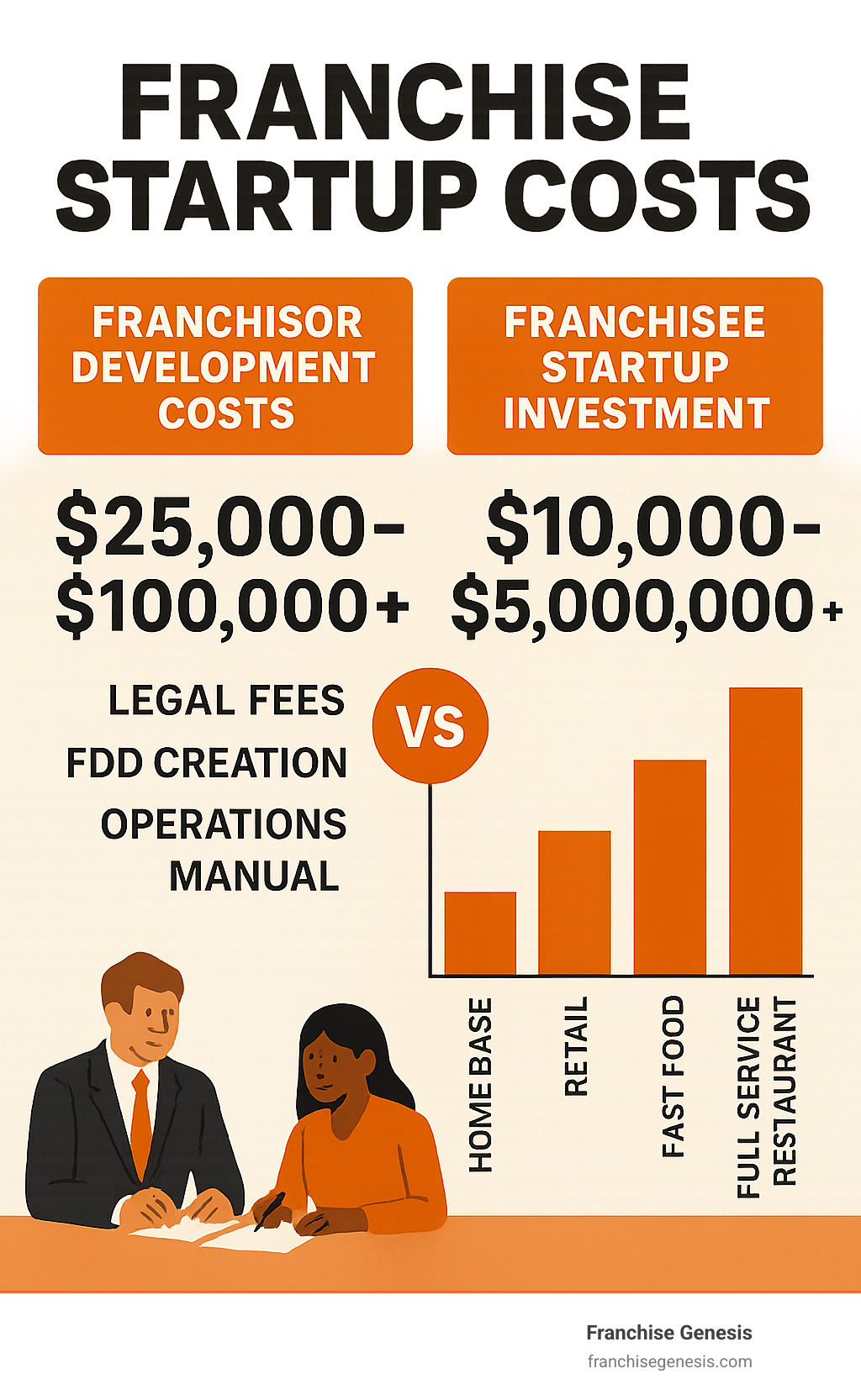

- Franchisor Development Costs: $25,000 – $100,000+ (legal fees, FDD creation, operations manual)

- Franchisee Investment Range: $10,000 – $5,000,000+ depending on industry

- Typical Franchise Fee: $20,000 – $50,000 (your first revenue stream)

- Ongoing Royalties: 4% – 8% of gross sales

- Key Components: Initial fee, equipment, real estate, inventory, working capital, professional fees

The research shows dramatic cost variations across industries. Home-based concepts can start under $10,000, while full-service restaurants require $750,000 to $3 million or more. Fast food franchises typically range from $250,000 to $1 million, and auto repair facilities run $200,000 to $300,000.

Understanding both sides of the equation – what it costs you to create a franchise system and what your franchisees will invest – is crucial for building a profitable, sustainable network.

As Monique Pelle-Kunkle, Vice President of Operations at Franchise Genesis, I’ve guided hundreds of business owners through the complex world of franchise startup costs, helping scale concepts from single locations to 100+ units within their first year. My experience has shown that transparent, well-structured franchise startup costs are the foundation of every successful franchise relationship.

The Initial Investment: What It Costs to Become a Franchisor

Here’s the reality check: before you can collect your first franchise startup costs from eager franchisees, you need to make a substantial investment yourself. Think of it as building the engine before you can drive the car.

This isn’t just paperwork and filing fees. You’re creating the entire blueprint that will guide every future franchise location. It’s the difference between having a great local business and having a scalable franchise system.

Legal documentation forms the foundation of everything. Your Franchise Disclosure Document (FDD) isn’t just a legal requirement – it’s your transparency promise to future franchisees. This comprehensive document covers everything from your company’s history to the exact investment requirements. The Federal Trade Commission mandates it, and specialized legal expertise is non-negotiable here.

Some states require you to register your FDD before you can even start selling franchises. Each state has different rules, timelines, and fees. Our Franchise Registration States Guide breaks down these requirements so you know exactly what to expect.

Creating your operations manual is where your business expertise really shines. This becomes the “secret sauce” handbook that ensures every franchise location delivers the same quality experience that made your original business successful. It covers daily procedures, customer service standards, marketing guidelines, and operational specifications. Without this manual, you’re essentially asking franchisees to guess how to recreate your success. Learn more about crafting this crucial document in our Franchise Operations Manual guide.

Brand marketing materials transform your local business story into a compelling franchise opportunity. You’ll need professional presentations, brochures, a dedicated franchise sales website, and other materials that clearly communicate your value proposition. These aren’t just pretty brochures – they’re your first impression with potential franchisees who might invest hundreds of thousands of dollars with you. Effective presentation strategies are covered in our Franchise Sales & Marketing resource.

Training program development ensures your franchisees can actually run the business successfully. You’ll design comprehensive programs covering initial onboarding, operational procedures, and ongoing support. This might include training manuals, video presentations, or even setting up a dedicated training facility. Your franchisees’ success directly impacts your ongoing royalty income.

Most business owners benefit from initial consulting fees with franchise experts. Unless you’ve franchised businesses before, navigating FTC regulations, state laws, and franchise structure optimization can be overwhelming. Experienced consultants help you avoid costly mistakes and build a system designed for sustainable growth from day one.

The total investment for becoming a franchisor typically ranges from $25,000 to $100,000 or more, depending on your business complexity and legal requirements. This upfront investment creates the framework for collecting franchise fees, ongoing royalties, and building a network that can generate revenue for decades.

Yes, it’s a significant commitment. But it’s also the foundation for changing your single location into a thriving franchise system that can scale far beyond what you could achieve alone.

Defining Your Franchisee’s Startup Costs in the FDD

Now that we’ve covered your costs as a franchisor, let’s discuss what your future franchisees will invest. This is where many new franchisors feel overwhelmed.

This information is detailed in Item 7 of your FDD: “Estimated Initial Investment.” This section is your promise of financial transparency, setting clear expectations for potential partners.

Getting these franchise startup costs right is critical. Accurate numbers attract prepared candidates, minimize disputes, and position your opportunity competitively. Upfront transparency builds the trust that is the foundation of every successful franchise relationship.

At Franchise Genesis, we’ve seen too many franchise systems struggle because they weren’t clear about investment requirements from the start. Don’t let that be your story.

The Initial Franchise Fee: Your First Revenue Stream

Your initial franchise fee is the first major payment a franchisee makes, marking the beginning of your partnership.

Setting the right fee requires balancing your development costs with the value of your brand. Most franchise fees fall between $20,000 and $50,000, though established brands can command more.

This fee isn’t just profit. It covers the license to operate, initial training, site selection assistance, marketing support, access to your operations manual, and proprietary software.

Incentives can attract specific candidates and drive growth. Veteran discounts, often through programs like VetFran, are popular. Multi-unit deals, with reduced fees for subsequent units, encourage faster expansion.

Building the Complete Picture of Franchisee Startup Costs

Beyond the franchise fee, your FDD must detail all other pre-opening costs, which vary significantly by business model.

Real estate and build-out costs are often the largest expense. A full-service restaurant can require a total investment of $750,000 to $3 million, while fast-food concepts range from $250,000 to $1 million. In contrast, home-based concepts can start for under $10,000, avoiding these costs.

Equipment and fixtures are the tools needed to deliver your brand promise, from machinery and POS systems to furniture. A restaurant might need $65,000 to $135,000 in equipment, while a service business would need less.

Initial inventory allows franchisees to serve customers from day one. A restaurant might need $6,000 to $10,000 in inventory, while a retail concept could require more.

Other costs include signage and decor for brand consistency, grand opening marketing (typically around $5,000), and professional fees for attorneys and accountants.

Most critically, working capital covers operating expenses like payroll and utilities for the first three to six months. Underestimating this is a common cause of failure.

For guidance on managing these complex supply relationships, check out our insights on Franchise Supply Chain management.

Setting Financial Requirements for Your Ideal Candidates

You must also establish clear financial qualifications to protect your franchisees and your brand. This is a key part of how we help clients Transform Leads into Loyal Franchisees with a Proven Sales Strategy.

Minimum liquidity requirements specify the cash a candidate must have to cover the initial investment and weather early business challenges. This can range from $150,000 to $750,000 or more.

Net worth requirements (total assets minus liabilities) demonstrate overall financial strength and ability to secure loans. This can range from $350,000 to $1.5 million.

A good credit history is non-negotiable, as it impacts financing options. Relevant business experience is also valuable, though some franchisors are willing to train motivated candidates from any background.

Clearly defining these requirements sets your future franchisees up for long-term success, which is the key to building a thriving network.

Structuring Ongoing Fees for Long-Term Success

Once your franchisees open their doors, the real partnership begins. Franchise startup costs are just the beginning—ongoing fees are what keep your entire system thriving and growing together. Think of these recurring payments as the fuel that powers your brand’s evolution, marketing reach, and the continuous support your franchisees need to succeed.

The beauty of well-structured ongoing fees is that they align your success with your franchisees’ success. When they grow, you grow. When you invest in better marketing or improved systems, they benefit directly. It’s a true partnership model that drives Franchise Growth Strategies for everyone involved.

Royalties and Ad Funds: The Engine of Your Franchise System

Royalty fees are the heartbeat of your franchise system. These ongoing payments—typically 4% to 8% of gross sales—give your franchisees continued access to your brand, systems, and ongoing support. It’s not just rent on your trademark; it’s payment for being part of a growing, evolving business network.

Here’s what makes this model so powerful: as your franchisees’ sales increase, your revenue grows too. This creates a natural incentive for you to help them succeed. When Wayback Burgers collects their 6% royalty or Subway takes their 8%, that money funds everything from new menu development to operational improvements that benefit every location.

National advertising funds work similarly but serve a different purpose. Most franchisors collect an additional 2% to 4% of gross revenues specifically for marketing. Subway’s 4.5% marketing fee pools resources from hundreds of locations to buy Super Bowl ads and national campaigns that no single franchisee could afford alone.

This collective marketing power is where the magic happens. Your franchisees get big-brand advertising reach while you get a sustainable way to build brand awareness and drive customer traffic system-wide.

Local marketing requirements round out the picture. Many franchisors require franchisees to spend an additional 1% to 2% of revenue on local advertising. This ensures your brand maintains visibility in each market while giving franchisees control over community-specific promotions.

Technology fees have become increasingly important as business systems become more sophisticated. Whether it’s your proprietary POS system, mobile apps, or inventory management software, these recurring fees ensure everyone stays current with the latest tools and features.

According to FranData, royalties have remained steady over recent years, showing that this model continues to work well for both franchisors and franchisees.

Other Potential Revenue Streams

Beyond the core royalty and advertising fees, smart franchisors often develop additional revenue streams that add value while generating income. Product markups through approved suppliers ensure quality control while creating profit opportunities. When you require specific ingredients, uniforms, or equipment, building in reasonable markups helps fund your supplier relationships and quality assurance programs.

Required software subscriptions for CRM systems, scheduling platforms, or inventory management tools create recurring revenue while ensuring all locations use compatible, up-to-date technology. Ongoing training fees for advanced workshops, leadership development, or new product launches help franchisees stay competitive while funding your training programs.

Annual conference fees cover the costs of bringing your network together for education, networking, and system updates. These events strengthen your franchise community while generating revenue to offset venue and speaker costs.

Renewal fees—typically charged when franchise agreements expire after 10 or 15 years—help cover the legal and administrative costs of extending partnerships with successful franchisees. These are usually set as a percentage of your current initial franchise fee.

The key is balancing these various revenue streams so they feel fair and valuable to your franchisees while giving you the resources to continuously improve and expand your system. When structured thoughtfully, ongoing fees become an investment in mutual success rather than just another business expense.

Guiding Franchisees to Success: Financing and Avoiding Pitfalls

Your role as a franchisor extends beyond collecting the initial franchise fee. The best franchise systems are genuine partnerships where you guide franchisees to financial success, as their prosperity fuels your growth. Think of yourself as a business mentor, an approach fundamental to Understanding the Key to Building a Thriving Franchise Network.

Common Financing Avenues for Your Franchisees

While you may not offer direct financing, educating franchisees on their options is invaluable. This empowers them to secure funding and expands your pool of qualified candidates.

SBA-guaranteed loans are an attractive option. The Small Business Administration guarantees a portion of loans from commercial lenders, reducing the bank’s risk and often leading to better terms. The 7(a) loan is popular for its flexible terms for startup costs, working capital, and equipment.

Traditional bank loans, including term loans and lines of credit, are a cornerstone of financing. Franchisees need good credit, a solid business plan, and often collateral. Your detailed FDD is crucial for providing lenders with the necessary transparency.

Rollovers for Business Start-ups (ROBS) allow franchisees to use retirement funds (401(k) or IRA) to finance their business without taxes or penalties by creating a C-corporation that invests in the business.

Equipment leasing reduces initial cash outlay, freeing up capital for other expenses. Building third-party lender relationships can also streamline financing for your franchisees, often leading to faster approvals and better terms.

Helping Franchisees Avoid Common Financial Mistakes

Even with a clear FDD, new franchisees can make financial mistakes. Your proactive guidance can prevent these issues and strengthen your network.

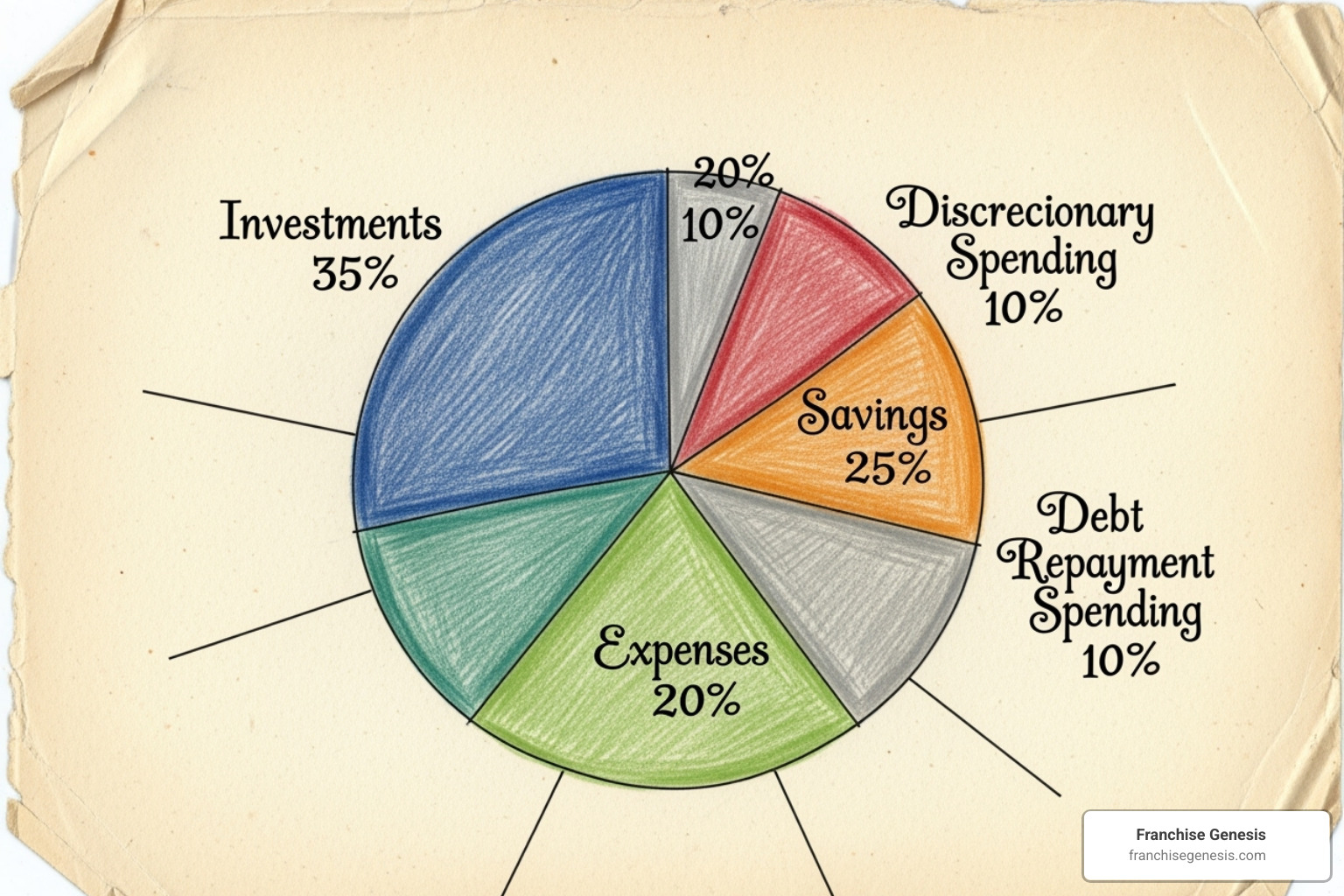

Underestimating working capital is the most dangerous mistake. Franchisees need enough cash to cover business and personal expenses for at least six months before profitability. Inadequate reserves are a primary cause of failure.

Misinterpreting the FDD is common. Encourage all prospects to hire qualified franchise attorneys and accountants to review the document. This professional guidance prevents future misunderstandings.

Poor cash flow management can sink an otherwise profitable business. Teach franchisees to create and monitor detailed cash flow projections. Basic financial management training is invaluable.

Not planning for seasonality is a common pitfall. If your business is seasonal, franchisees must build cash reserves during peak times to cover expenses during slower months.

A solid business plan is a critical roadmap, not just paperwork for lenders. It forces franchisees to detail market analysis, marketing, operations, and financial projections, helping them anticipate challenges.

By addressing these financial challenges, you protect individual franchisees and build a more resilient franchise network for everyone.

Frequently Asked Questions about Creating a Franchise System

Having helped hundreds of business owners franchise, I’ve seen the same financial questions arise repeatedly. Here are the answers to the most common concerns.

How much does it cost to turn my business into a franchise?

Turning your business into a franchise system typically requires an investment of $25,000 to $100,000 or more.

This franchise startup cost covers your initial development. Legal and consulting fees are a major component, as you’ll need specialized attorneys to draft your Franchise Disclosure Document (FDD) and Franchise Agreement. Other key expenses include creating a detailed operations manual to ensure consistency and developing professional marketing collateral (website, brochures) to attract franchisees.

While substantial, this investment builds the foundation for exponential growth. We’ve seen clients scale to over 100 units in their first year.

How do I determine the right franchise fee and royalty for my brand?

Setting your fees is a balance between attracting qualified franchisees and ensuring your system’s profitability.

Begin with a competitive analysis. Initial franchise fees typically range from $20,000 to $50,000, and ongoing royalties are usually 4% to 8% of gross sales. Your fees should reflect the value of support provided (training, marketing, technology). The goal is profitability for both parties; fees that are too high can cause franchisee failure, while fees that are too low can underfund your support systems. Also, consider industry norms, as models like Food Franchise Opportunities differ from Home-Based Franchise Opportunities.

The key is finding a balance that works for everyone. Your fees should cover your costs, allow for reinvestment in the brand, and still leave your franchisees with a profitable business model.

What is the most important part of disclosing franchise startup costs?

The most critical aspect is transparency and accuracy in Item 7 of your FDD, which is foundational to your franchise relationships.

Transparency requires a complete picture of all costs, not just the franchise fee. This includes real estate, equipment, inventory, and working capital. Accuracy is also vital; your estimates should be based on real-world data from your own locations or solid research. You must provide detailed notes and ranges in Item 7 to explain your estimates and account for variables like location.

Clear disclosure helps avoid franchisee disputes that arise from unexpected costs. The legally required 14-day review period for the FDD allows prospects to get professional advice. As noted in The Costs Associated with Operating a Franchise, this transparency is key. Accurate disclosure is about setting your franchisees up for success from day one.

Conclusion

You’ve just walked through the complete financial landscape of franchising – from your initial investment as a franchisor to helping your future franchisees succeed. Franchise startup costs might seem overwhelming at first glance, but they’re really the building blocks of something much bigger: a thriving network of successful business partners.

Think of it this way: every dollar you invest in creating your franchise system, every fee structure you carefully design, and every bit of financial guidance you provide to franchisees is laying the groundwork for sustainable growth. It’s not just about the money – it’s about creating relationships built on trust, transparency, and mutual success.

The most successful franchise systems we’ve worked with all share one common trait: they understand that clear financial communication is the foundation of everything. When you accurately disclose costs in your FDD, structure fair ongoing fees, and guide your franchisees toward sound financing decisions, you’re not just following legal requirements – you’re building partnerships that last.

Your journey from single location to franchise system doesn’t have to be traveled alone. The financial complexities we’ve covered – from FDD preparation to royalty structures to helping franchisees avoid common pitfalls – require expertise that comes from years of experience in the franchising world.

At Franchise Genesis, we’ve guided hundreds of business owners through exactly this process. We help you structure those crucial financial frameworks that turn your proven business model into a scalable, profitable franchise system. Whether it’s determining the right franchise fee, crafting transparent cost disclosures, or building ongoing revenue streams that benefit everyone, we’re here to make sure your numbers work for the long haul.

Ready to transform your successful business into a franchise system with rock-solid financials? Explore our services for franchisors and franchisees and let’s build your franchise future together.