Why Business Owners Need Smart Financing Strategies for Franchise Expansion

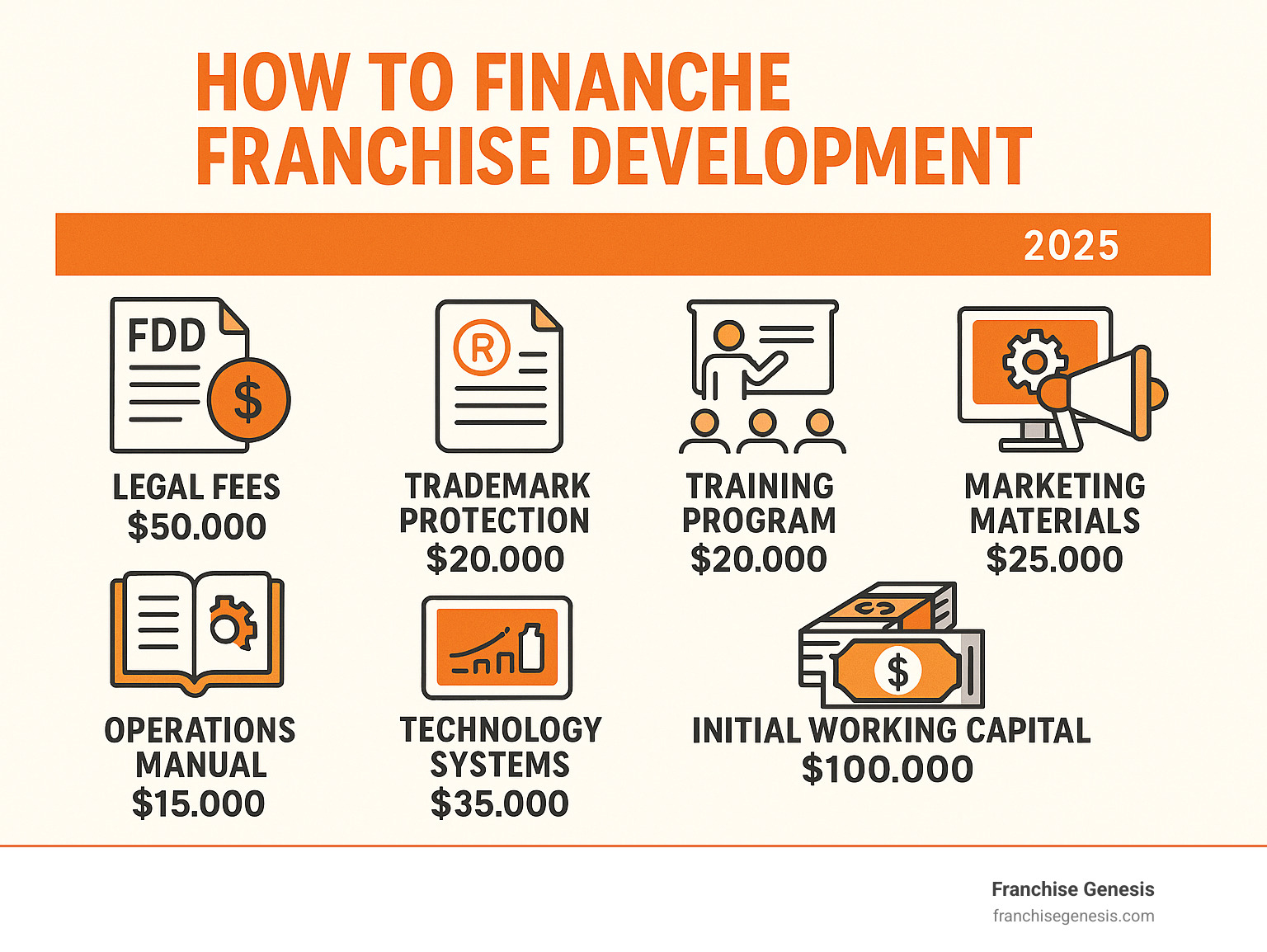

How to finance franchise expansion is one of the biggest challenges facing successful business owners ready to scale. Whether you’re funding legal requirements, operations manuals, or marketing campaigns to attract franchisees, the cost to franchise your business can range from $350,000 to over $1 million, depending on your industry and growth goals.

Quick Answer: How to Finance Franchise Development

- Traditional Business Loans – Term loans and lines of credit for expansion capital

- SBA Loans – Government-backed financing with lower down payments and longer terms

- Equity Investors – Angel investors or venture capital in exchange for ownership stake

- Personal Assets – Home equity loans, retirement funds (ROBS), or personal savings

- Alternative Funding – Crowdfunding, friends and family loans, or franchisor financing programs

The journey from running a single location to becoming a franchisor requires significant upfront investment. You’ll need capital for legal documentation like your Franchise Disclosure Document (FDD), operations manuals, training programs, marketing materials, and ongoing support systems.

“Financing is often the biggest hurdle when creating your own franchise empire.” Franchising your business means building the entire infrastructure from scratch – and that takes serious capital.

As Monique Pelle Kunkle, Vice President of Operations at Franchise Genesis, I’ve guided countless business owners through the complex process of how to finance franchise development, helping scale everything from ABA therapy concepts to wellness studios. My experience shows that the right funding strategy can make the difference between a franchise that struggles and one that reaches 100+ locations within its first year.

Explore more about How to finance franchise:

Understanding the Financial Leap: What It Costs to Franchise Your Business

When you decide to how to finance franchise development, you’re investing in building an entire business system from the ground up. Think of it like the difference between buying a house and becoming a home builder. The financial commitment is substantial, but so is the potential reward.

Most business owners need between $350,000 and $1 million to properly franchise their business. This is an investment in creating the infrastructure that will allow other entrepreneurs to replicate your success story across multiple locations.

These costs fall into three main buckets: getting legally compliant, building your operational systems, and marketing your franchise opportunity. Let’s break down what each area costs.

The Legal and Structural Foundation

Your Franchise Disclosure Document (FDD) is the legal blueprint for your franchise system, required by the Federal Trade Commission. Creating a compliant FDD, securing trademark protection, handling incorporation, and managing state filing fees requires significant legal expertise. Expect to invest $50,000 to $100,000 in attorney fees for a properly developed franchise system.

Building the System: Operations and Training

Here, your business expertise is transformed into teachable, repeatable systems. This includes creating comprehensive operations manuals ($25,000 – $75,000) and developing robust training programs ($50,000 – $150,000). You’ll also need to invest in technology and software infrastructure ($20,000 – $100,000) to ensure franchisees can replicate your success using your proven methods.

The goal is creating a “business in a box” – everything a franchisee needs to succeed. For more detailed guidance, check out our guide to franchising your business.

Marketing and Selling Your Franchise

Once your system is built, you must attract the right franchisees. Franchise marketing is completely different from customer marketing; you’re selling a business opportunity.

Costs include website development for recruitment ($15,000 – $50,000), ongoing lead generation and sales commissions, and trade show expenses ($25,000 – $100,000 annually). Many franchisors budget 15-20% of franchise fees for broker commissions, while direct marketing campaigns can cost $5,000 to $20,000 monthly.

The investment is significant, but every dollar spent building a solid franchise system pays dividends when you have dozens of franchisees paying ongoing royalties. When you understand how to finance franchise development properly, you’re setting the foundation for exponential growth.

Securing Capital: Traditional Loans for Franchise Expansion

Now that we understand the costs, let’s explore how to finance franchise expansion using traditional lending. As an established business owner, you’re seeking expansion capital, and lenders view proven businesses more favorably than new ventures.

Lenders will want to see a complete financial picture, including personal and business financial statements, tax returns, and a strong credit history. Your existing business’s proven revenue streams and documented success are major advantages. A strong business plan is your secret weapon, telling a compelling story about your vision for scaling and presenting realistic financial projections.

As Muhammad Saqib, Manager at BDC’s Entrepreneurship Centre, notes, “You need money set aside either through your own equity position or the banks. Availability of sufficient funds is key.”

Lenders evaluate applications based on the 5 Cs of Credit: Character, Capacity, Capital, Conditions, and Collateral. Your established brand and proven system strengthen your application considerably.

How to Finance a Franchise with Government-Backed Loans

Government-backed loan programs can be game-changers, as they share risk with lenders, making loan approval more likely.

In the United States, SBA loans are a popular option. The SBA 7(a) program offers flexible financing for working capital or equipment, with lower down payments and longer repayment terms than conventional loans. The SBA 504 program focuses on fixed-rate financing for major assets like real estate. While not for startup costs, it’s ideal if your expansion requires a corporate training center.

The main advantage of SBA loans is the government guarantee, which reduces the bank’s risk. The trade-off is higher upfront fees and a personal guarantee requirement. You can explore more details at SBA Loans for Franchises.

For Canadian business owners, the Canada Small Business Financing Program (CSBFP) works similarly by sharing risk with lenders, making approval more likely for your franchisor entity.

Learn more about SBA franchise financing to see if this path makes sense for your expansion plans.

Conventional Bank Loans and Lines of Credit

Conventional bank loans offer another solid path for how to finance franchise development, often with lower interest rates and reduced origination costs compared to SBA loans.

Term loans provide a lump sum with a fixed repayment schedule, ideal for major development expenses. Lines of credit offer flexibility, allowing you to draw funds as needed and pay interest only on what you use. This is invaluable for managing cash flow fluctuations before franchisee royalties start flowing.

If your expansion involves significant equipment, equipment financing uses the equipment itself as collateral, freeing up other capital.

Building a strong relationship with a commercial bank pays dividends. At Franchise Genesis, we help clients prepare presentations that showcase their current success and a clear vision for scalable growth. The key is demonstrating that your proven business model, combined with the right financing, creates a winning formula for expansion. More info about franchise loan rates can help you understand what to expect.

Fueling Growth with Equity: Investors and Partners

When traditional loans aren’t enough or you want to accelerate growth without debt, bringing in equity investors is an attractive option. The trade-off is simple: you get capital without monthly payments but give up a portion of ownership and some control.

Instead of owing a bank, you’re bringing on partners who share the risks and rewards. These partners often bring more than just money, which is valuable as you steer how to finance franchise development.

Attracting Angel Investors and Venture Capital

Angel investors and venture capital firms invest in high-potential businesses in exchange for significant returns. To attract them, your pitch must tell a compelling story of how your successful business will scale as a franchise. Be prepared for an intense business valuation and a thorough due diligence process.

The major advantage of these investors is the expertise and network they bring. They can provide strategic guidance and open doors to potential franchisees, suppliers, or additional funding. While this can be the most expensive source of capital long-term, their contribution can be transformative. You can explore platforms like AngelList to connect with potential investors.

The Friends and Family Route

Your inner circle is often an accessible source of capital, typically offering lower interest rates and flexible repayment schedules. The process is simpler than with traditional lenders, as personal relationships and trust play a larger role.

However, mixing money with personal relationships carries risks. To avoid potential for relationship strain, the importance of formal loan agreements cannot be overstated. As financial expert Suzanne Llanera wisely notes, “Having a loan agreement in place can save you a lot of trouble in the long term, especially if you fail to pay off the loan or if any family member demands something that wasn’t agreed upon at the beginning.”

A written contract that clearly defines the investment amount, interest, repayment schedule, and contingencies protects everyone involved. This clarity helps preserve both your relationships and your business as you work on how to finance franchise expansion.

Alternative and Self-Funding Strategies

Sometimes the best source of funding is your own. Many successful business owners find that how to finance franchise development doesn’t always require external parties. Your own assets can provide the capital you need while keeping you in complete control.

The beauty of self-funding lies in its simplicity and independence. You’re not waiting for loan approvals or giving up equity, but leveraging the success you’ve already built.

Using Your Own Assets to Fund Your Franchise Dream

Personal cash injection is the most direct approach, giving you complete control and avoiding debt. However, it’s wise to invest no more than 75% of your cash reserves to maintain a safety net for unexpected challenges.

Using home equity through a Home Equity Loan (HEL) or Line of Credit (HELOC) is another powerful option. These offer lower interest rates because your home serves as collateral. The main consideration is the risk: your home is on the line, so borrowing conservatively is crucial to manage payments even if business doesn’t go exactly as planned.

The primary advantage of self-funding is maintaining full control while avoiding debt that could strain cash flow during the critical early months of franchise development. The trade-off is the personal financial risk involved.

How to Finance a Franchise Using a ROBS Plan

Rollover as Business Startups (ROBS) is a sophisticated strategy for those with substantial retirement savings. It allows you to use your 401(k) or IRA funds to finance your franchise development without early withdrawal penalties or immediate tax consequences.

The process involves creating a new C-Corporation for your franchisor entity and rolling your retirement funds into its new 401(k) plan. The plan then invests in your corporation’s stock, providing the capital for development costs.

This strategy is appealing because the money remains in a tax-advantaged retirement vehicle. However, ROBS plans require meticulous adherence to complex IRS rules and are subject to intense scrutiny. The setup process is intricate and requires working with qualified specialists who understand the regulatory requirements.

The stakes are high, as failure could mean losing a substantial portion of your retirement savings. Due to the complexity and risk, consult with experienced ROBS specialists and financial advisors before pursuing this option. Remember Muhammad Saqib’s words: “Not incorporating enough working capital is a common reason many franchises fail.” Ensure you’re preserving adequate capital for ongoing operational needs.

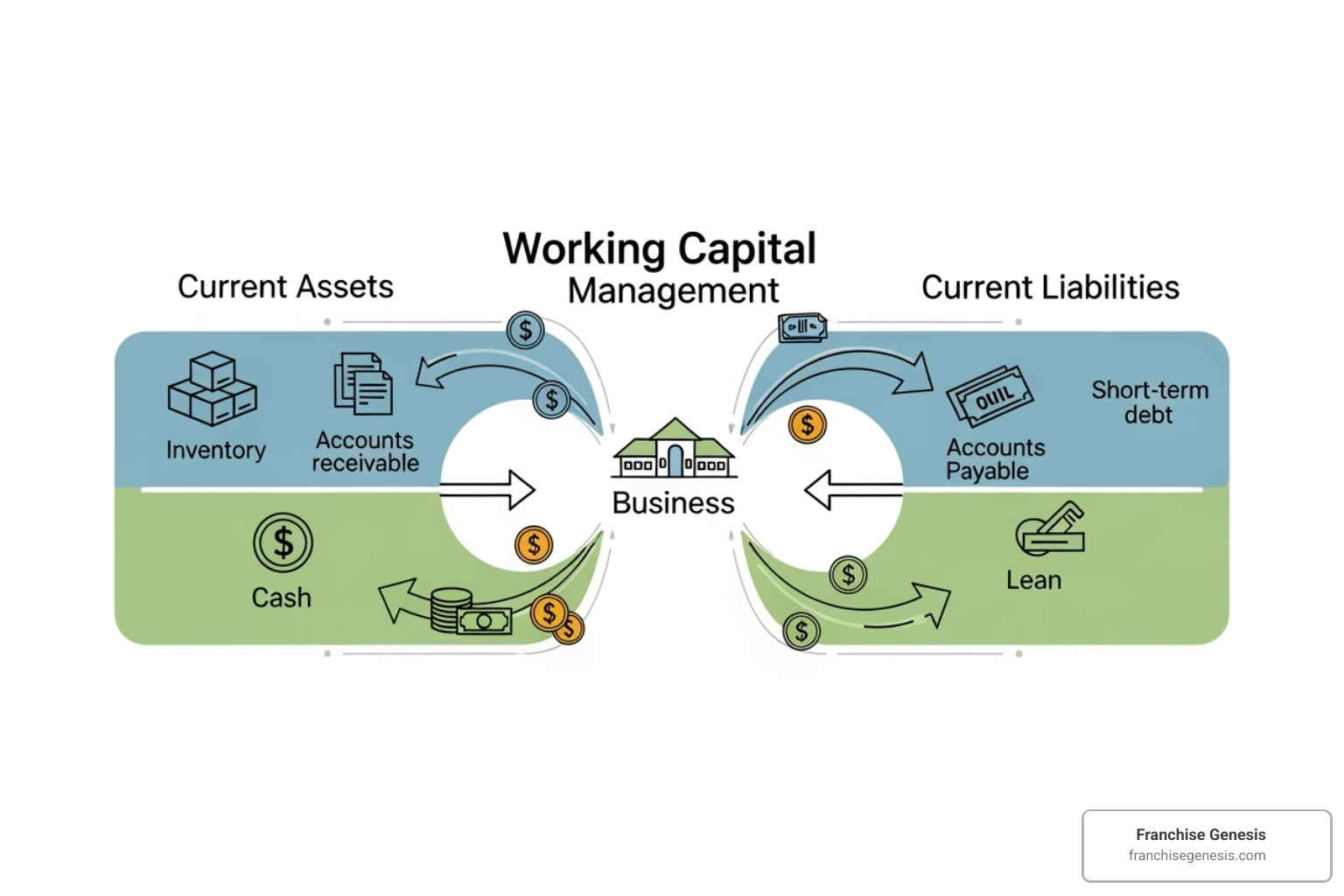

The Importance of Working Capital in Your Franchise System

When figuring out how to finance franchise development, don’t underestimate your working capital needs. Working capital is the cash on hand to cover day-to-day expenses. For a new franchisor, it’s the financial cushion that keeps your doors open while you build your empire.

Working capital is the lifeline that covers initial operating losses before royalty checks become consistent. It’s also essential for supporting new franchisees through training and on-site visits, handling unexpected expenses, and sustaining growth while you wait for franchisee revenue to ramp up.

As Muhammad Saqib from BDC puts it perfectly: “Not incorporating enough working capital into your project costs is one of the reasons many franchises fail.” This is why we always tell our clients to factor substantial working capital into their funding requests. Lenders and investors appreciate seeing that you understand the real financial demands of building a successful franchise system.

When creating your funding strategy, working capital isn’t just another line item – it’s your lifeline. Plan for at least six to twelve months of operating expenses, and you’ll be better prepared to weather the inevitable storms of franchise development.

Learn more about what franchising is.

Conclusion

Building a franchise from your successful business is an exciting growth opportunity. It’s your chance to share your proven concept with passionate entrepreneurs while creating multiple revenue streams.

Throughout this guide, we’ve explored how to finance franchise development, from the initial $350,000 to $1+ million investment to the various funding paths available. Traditional and SBA loans let you maintain ownership, while equity investors offer capital and expertise for a stake. Self-funding provides independence but carries personal risk.

Often, the best strategy is a mix of these options custom to your goals. Long-term financial planning is key. As your franchise network grows and royalty payments create steady cash flow, you’ll have built a system that generates income from multiple locations while helping other entrepreneurs succeed.

At Franchise Genesis, we’ve guided countless business owners through this exact journey. We know how to structure your plan to secure funding and build the working capital reserves needed for growth during those critical early phases.

Your successful business is already proof that you have what it takes. Now it’s time to scale that success into a franchise empire.