Understanding the Foundation of Your Franchise Business Model

Franchise investment options are the structural choices that determine how much capital franchisees need, what it covers, and how you’ll generate ongoing revenue. Structuring this investment correctly is critical: it must attract qualified candidates while ensuring your franchise system is financially viable. Set the bar too high, and you’ll struggle to find franchisees. Set it too low, and you risk bringing in undercapitalized partners who can’t succeed.

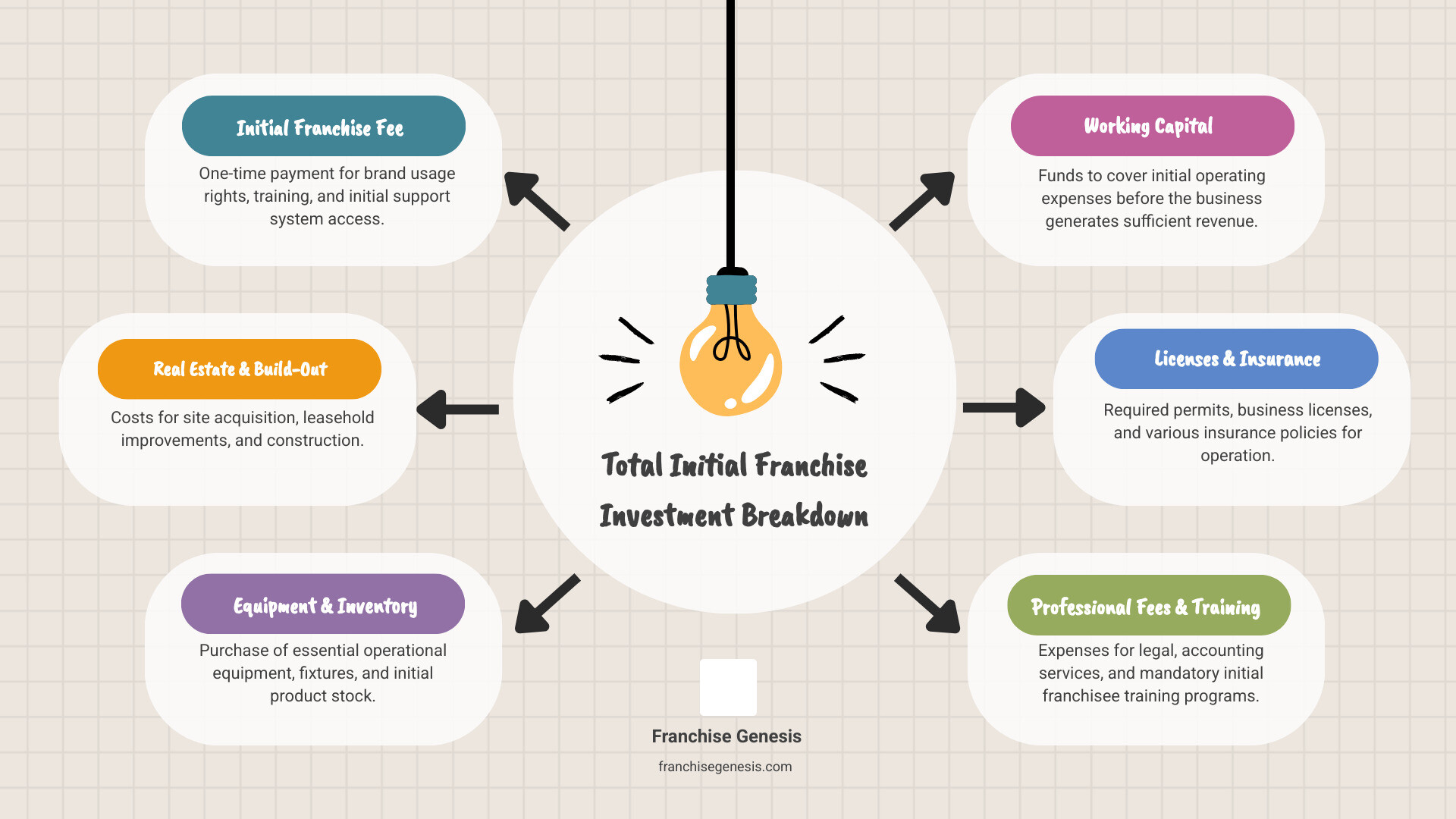

Key Franchise Investment Components:

- Initial Franchise Fee: A one-time payment for the right to use your brand and system.

- Total Initial Investment: The full startup cost, including real estate, equipment, and working capital. This can range from under $10,000 for home-based concepts to over $4 million for large venues.

- Liquid Capital Requirement: The unencumbered cash a franchisee must have available.

- Net Worth Threshold: The total assets minus liabilities a candidate must meet.

- Ongoing Royalties: Recurring fees (typically 4-6% of gross sales) that fund your support system.

- Marketing/Ad Fund: Collective contributions (usually 1-3%) for brand-wide advertising.

Your role as a franchisor is to determine where your concept fits on this investment spectrum and package it to maximize franchisee success and system growth.

I’m Monique Pelle Kunkle, Vice President of Operations at Franchise Genesis. I’ve helped countless business owners structure their franchise investment options to attract the right candidates and scale successfully. This article will walk you through building an investment structure that aligns with your business model and growth goals.

Key terms for Franchise investment options:

Deconstructing the Franchise Investment: What Your Franchisees Will Pay

When setting up your franchise, you must understand every dollar your franchisees will need to open and operate through the critical first few months. This isn’t just good practice; it’s a legal requirement. Your Franchise Disclosure Document (FDD) must clearly outline the complete financial picture to protect both you and your franchisees.

The total investment figure is comprehensive, including the initial franchise fee, real estate expenses, equipment costs, initial inventory, insurance, professional fees, training, and crucial working capital to cover operations until the business achieves positive cash flow.

Franchise investment options vary wildly by industry. A quick-service restaurant might require $450,000 to $875,000, while a full-service restaurant could exceed $2.6 million. However, many service-based or home-based models have much lower entry points, sometimes starting around $43,000. The key is to be honest about what it takes to succeed with your concept.

Want to dive deeper? See our guide on How Much Does It Cost to Franchise My Business?.

The Initial Franchise Fee: Your First Revenue Stream

The initial franchise fee is the upfront payment a franchisee makes to use your brand, trademarks, and business model. This fee typically covers the initial training program, site selection assistance, and grand opening support. It’s your franchisee’s ticket to your established system.

Setting this fee requires balancing your brand’s strength, the comprehensiveness of your support, and industry benchmarks. Fees often range from $15,000 to $30,000 or more. The fee should reflect the value proposition you offer while remaining attractive to your target franchisee. This revenue helps offset your costs in developing the franchise system and onboarding new partners. Learn more about the process at Franchise Your Business.

Build-Out, Real Estate, and Equipment Costs

For brick-and-mortar concepts, these costs represent the largest portion of the total investment. Leasehold improvements transform a generic space into your branded location, while construction estimates are needed for new builds. The equipment package includes everything from kitchen appliances to specialized machinery and POS systems.

A full-service restaurant might require $750,000 to $1 million, with a large portion dedicated to build-out and equipment. As a franchisor, you must provide detailed, accurate cost ranges. Establishing preferred vendor relationships can help franchisees get better pricing, ensure brand consistency, and streamline the process. For more on this, explore our guide to Franchise Real Estate.

Working Capital: The Safety Net for a Strong Start

Working capital is the financial cushion franchisees need to cover operating expenses like payroll, rent, and marketing during the first few months before the business becomes self-sustaining. We typically recommend calculating enough working capital to cover three to six months of operations.

Without adequate working capital, even a promising franchisee can fail. If they run out of cash before hitting their stride, the quality of the location and training becomes irrelevant. Franchisee financial health depends on having enough capital not just to open, but to succeed. When building your investment structure, be conservative with your estimates to ensure you build a stronger, more sustainable franchise system. See our detailed guide on Franchise Startup Costs for a complete picture.

Structuring Your Franchise Investment Options to Attract Quality Candidates

One size rarely fits all in franchising. When structuring your franchise investment options, it’s wise to design multiple pathways for different types of entrepreneurs to join your system. This means creating options that match your brand’s needs and your ideal franchisee’s capabilities, adapting them to different markets and growth stages.

The All-In-One Model: Brick-and-Mortar

The traditional brick-and-mortar franchise is what most people picture: a full-service location with a physical storefront. This model typically requires the highest investment due to real estate, build-out, and equipment costs. For example, a Swiss Chalet franchisee invests between $1.3 million and $1.6 million. In return, they receive an established supply chain, detailed operational systems, and robust marketing support. If your business relies on a physical atmosphere, this may be your primary option.

The Low-Cost Entry Point: Mobile or Service-Based Franchises

Many of the fastest-growing franchise systems operate with minimal overhead, offering mobile or home-based services. These models open your franchise to entrepreneurs who have the drive but not access to seven-figure capital. Industries like commercial cleaning, fitness coaching, and web development can thrive from a home office.

These franchises can launch in weeks instead of months, as they bypass site selection and construction. This flexibility appeals to entrepreneurs seeking to build a business without high fixed costs and dramatically expands your candidate pool. Explore Home-Based Franchise Opportunities to see if this fits your brand.

Exploring a Range of Franchise Investment Options

Smart franchisors don’t limit themselves to one model. They explore a range of franchise investment options to adapt to different markets. A kiosk may work in a mall, a storefront in a suburb, and a mobile unit in a rural area.

| Model Type | Initial Cost (Range) | Overhead (Typical) | Scalability (Individual Unit) | Example Industries |

|---|---|---|---|---|

| Brick-and-Mortar | High ($200K – $6M+) | High | Moderate | Food, Retail, Automotive Service |

| Mobile/Service-Based | Low ($10K – $100K) | Low | High | Cleaning, Coaching, Pet Grooming |

| Kiosk/Small Footprint | Medium ($50K – $300K) | Medium | High | Coffee, Dessert, Specialty Retail |

Each model attracts different candidates. A franchisee might start with a mobile unit and later upgrade to a brick-and-mortar location. The goal is to identify which variations of your model make strategic sense while maintaining brand standards.

Multi-Unit Development: Fueling Rapid Growth

Once your system is proven, multi-unit development is a powerful growth strategy. This involves area development agreements where a franchisee commits to opening multiple locations in a territory. This attracts sophisticated investors looking to scale, not just own a single business.

For you, this means faster market penetration and fewer individual relationships to manage. We help structure multi-unit incentives, like reduced franchise fees for subsequent units, to make these deals attractive. This strategy is key to accelerating your Franchise Unit Growth and should be part of your long-term plan.

Setting Financial Requirements for Your Future Franchisees

Setting financial requirements isn’t about creating barriers; it’s about ensuring franchisees have the foundation to succeed. Setting the bar too low can lead to undercapitalized franchisees who struggle and fail, which damages your brand. A proper vetting process rests on three pillars: liquid cash requirements, net worth thresholds, and lender relationships.

Determining Minimum Liquid Cash Requirements

Liquid capital is cash or assets that can be quickly converted to cash. This is not money tied up in retirement accounts or home equity. It’s the accessible funds needed for initial startup costs and to cover operations while revenue builds. The amount varies by business model. For example, many food franchises like Freshii or Pita Pit require $150,000+ in liquid cash.

These numbers reflect the reality of the ramp-up phase. We help you calculate the right liquid capital requirement based on your total investment, working capital needs, and the time it takes your model to reach positive cash flow.

Establishing a Net Worth Threshold

While liquid capital covers immediate needs, net worth (total assets minus total liabilities) demonstrates a franchisee’s overall financial health. This figure gives you and potential lenders confidence in their long-term viability. It also makes your franchise more “bankable,” making it easier for candidates to secure financing.

Industry standards vary, with brands like Pet Valu and Booster Juice requiring a minimum net worth of $500,000. The threshold should be high enough to ensure stability but not so high that it eliminates excellent candidates who could secure financing. It’s a delicate calculation based on your specific business model.

The Role of Third-Party Lenders

Most franchisees use a combination of their own capital and financing from third-party lenders. As a franchisor, you can streamline this process by building relationships with lenders who understand your business model. In the U.S., SBA loans are a popular option.

We guide you through getting your franchise listed on the Franchise Registry, which pre-approves your concept for financing with participating lenders. This makes the loan process faster and smoother for your candidates. By actively assisting with financing, you strengthen your entire system. Learn more in our Franchise Financing Options Complete Guide.

The Ongoing Investment: Building a Sustainable Royalty Structure

The initial franchise fee is just the beginning. The true financial engine of your franchise system is the ongoing royalties and marketing contributions. This recurring revenue funds your support infrastructure and allows you to continuously invest in your franchisees’ success long after their grand opening.

Calculating a Fair and Sustainable Royalty Fee

The royalty fee is typically a percentage of a franchisee’s gross sales, paid weekly or monthly. This fee funds everything you provide post-launch, from field support to technology updates. The fee must be high enough to support robust services but reasonable enough for franchisees to achieve healthy profitability. Industry standards often range from 5-6% of gross sales, though some specialized models charge more. A Franchise Feasibility Study can help determine the right balance for your business.

Building a Brand Fund: The Power of Ad Royalties

Beyond operational royalties, a separate brand fund or advertising royalty is crucial. This money is earmarked for system-wide marketing, such as national campaigns and digital advertising. While a single franchisee has limited marketing power, a collective fund of 1-4% of gross sales from the entire network creates serious marketing muscle.

This collective approach is a core value proposition of franchising, giving franchisees access to professional campaigns they could never afford alone. This brand awareness drives customers to all locations. We recommend transparent ad fund management so franchisees see how their contributions are building the brand.

Why Franchisee Satisfaction is Your Best Investment

Your most valuable investment is in your franchisees’ satisfaction and profitability. Happy, profitable franchisees become your best marketing tool. When prospective candidates conduct validation calls with existing franchisees, you want them to hear enthusiasm about your training, support, and the financial opportunity.

The Franchisee Satisfaction Index (FSI), an industry benchmark, shows that high satisfaction correlates with stronger growth and retention. When your franchisees are satisfied, they become advocates who sell your opportunity more effectively than any ad campaign. Therefore, your fee structure must allocate adequate resources for franchisee support. Cutting corners here is a recipe for long-term failure. A thriving franchise system is built on this mutual success.

Frequently Asked Questions about Franchise Investment Options

As you structure your franchise investment options, several key questions are likely to arise. Here are concise answers to the three most common ones we hear.

How do I determine the right initial franchise fee for my business?

Your initial franchise fee should be a strategic balance of three factors: the value and recognition of your brand, the comprehensiveness of your training and support systems, and competitive industry benchmarks. The fee must cover your onboarding costs and reflect the value you provide, while remaining attractive to qualified candidates.

What is included in the total investment estimate I provide in the Franchise Disclosure Document (FDD)?

The total investment estimate in your FDD is a legally required low-to-high range that must be comprehensive. It includes the initial franchise fee, real estate costs (lease deposits, build-out), equipment, initial inventory, insurance, professional fees, signage, and, crucially, recommended working capital to cover operating expenses for the first three to six months.

Can I offer different franchise investment options for different market sizes?

Yes, and it’s often a smart strategy. Offering flexible franchise investment options allows you to adapt to diverse markets. You can create a flagship model for major cities and a scaled-down, lower-cost version for smaller communities. You might also offer different operational models, like kiosks or mobile units, to expand your reach and attract a wider range of franchisees while maintaining brand standards.

Conclusion

Creating the right franchise investment options is about building a foundation for mutual success. Your investment structure is the bridge between your proven business model and the qualified entrepreneurs ready to help you scale. It must be strong enough to support growth but accessible enough for the right partners to join.

When your initial fees reflect real value, startup costs are transparent, financial requirements protect everyone, and your royalty structure sustains excellent support, you attract quality franchisees. They invest with confidence because the path to success is clear.

Getting this structure right requires deep industry knowledge and strategic planning. At Franchise Genesis, we specialize in this process. We help you calculate investment ranges that prevent undercapitalization, structure royalties that fund exceptional support, and build a financial model designed for long-term, sustainable growth.

Your franchise investment options are the blueprint for your franchise family. Let’s get them right. Find out how our Services for Franchisors and Franchisees can transform your business into a thriving franchise network.