Why Business Loans Are Essential for Your Growth Strategy

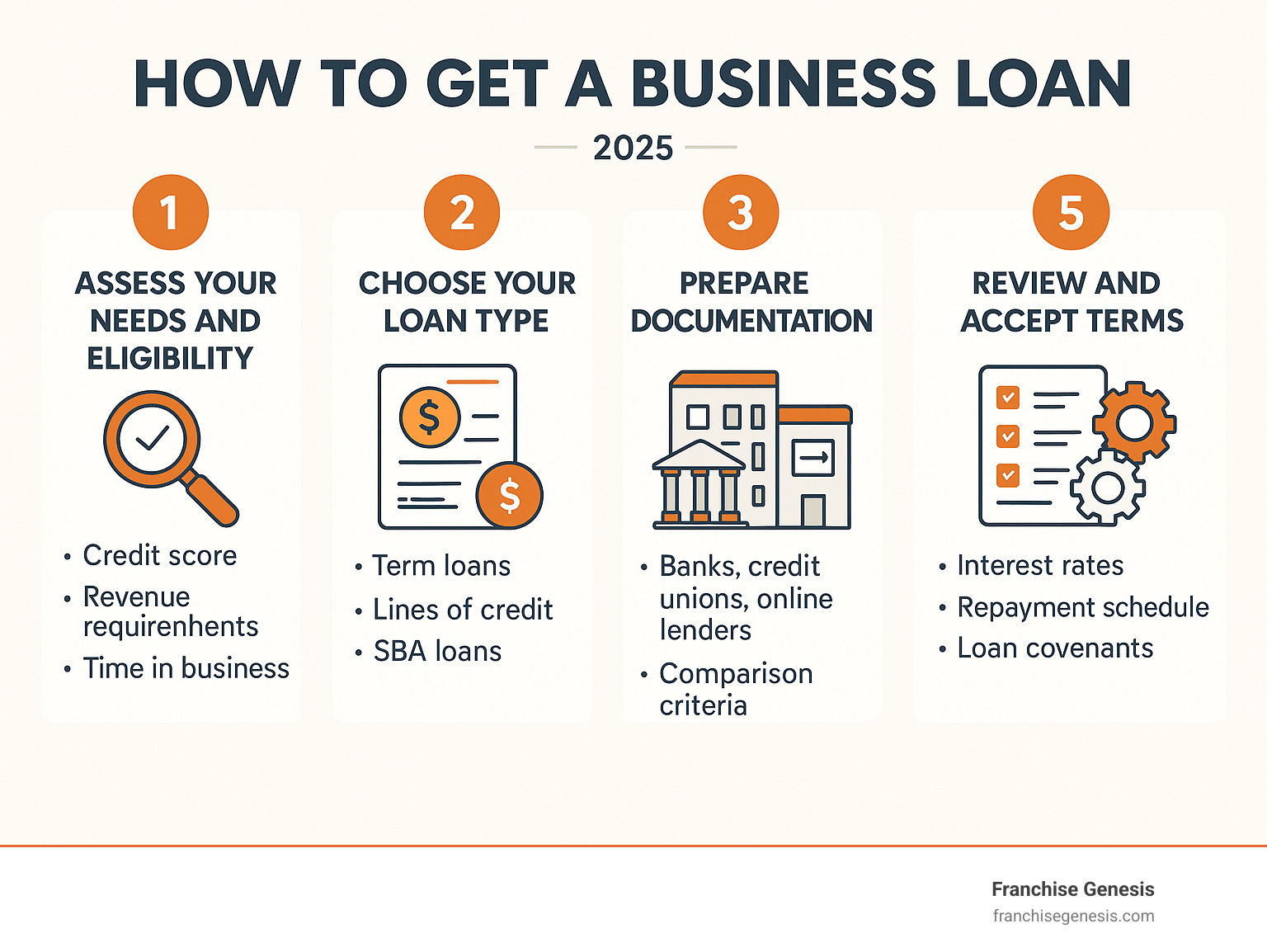

Knowing how to get a business loan is a critical skill for any business owner planning to expand, especially through franchising. The process involves five key steps, from checking your eligibility to negotiating favorable terms.

Quick Answer: How to Get a Business Loan

- Check eligibility – Need 2+ years in business, $50k-$250k annual revenue, 680+ credit score

- Prepare business plan – Include financial projections and specific use of funds

- Gather documents – Tax returns, financial statements, bank statements, legal documents

- Research lenders – Compare banks, credit unions, online lenders, and SBA programs

- Apply and negotiate – Submit application and review loan terms carefully

Whether you need working capital, expansion funding, or franchising capital, business loans provide the financial foundation for growth. Most lenders require at least two years in business with annual revenues between $50,000 and $250,000.

The loan landscape offers multiple options, from traditional term loans and lines of credit to government-backed SBA loans. Each serves different purposes and has varying requirements and terms.

Getting approved requires presenting a compelling case that shows lenders you can repay the debt while growing your business. With the right preparation, most businesses that apply for financing receive approval for some or all of their requested amount.

I’m Monique Pelle-Kunkle, Vice President of Operations at Franchise Genesis. I’ve guided countless business owners through the process of how to get a business loan to fuel their franchise expansion. My experience scaling franchise concepts has shown me exactly what lenders look for and how to position your business for success.

Terms related to how to get a business loan:

Pre-Application Strategy: Assessing Needs and Loan Types

Before applying, it’s crucial to understand your financial needs and loan options. This foundational step will save you time and money as you learn how to get a business loan for your franchising journey.

Determining Your Funding Needs

Accurately calculating your funding needs is essential. Business owners often ask for too little and run short, or ask for too much and struggle with payments. When franchising, you’ll need capital for legal fees (like your Franchise Disclosure Document), marketing materials, training program development, and potential upgrades to your flagship location.

Your cash flow analysis is critical. Lenders use the Debt Service Coverage Ratio (DSCR) to measure if your business generates enough cash to cover its debt payments. A DSCR of 1.25 or higher is standard, but a ratio of 2.0 is ideal, as it shows your business generates twice the cash flow needed to cover debt. This affordability check protects your business from taking on unmanageable debt.

Understanding Different Business Loans

Choosing the right loan type is key to achieving your franchising goals. Let’s break down the common options.

Term loans provide a lump sum upfront, which you repay with fixed monthly payments over a set period. They are ideal for specific, one-time expenses like developing a franchise operations manual or setting up a training facility.

Lines of credit offer flexibility. You’re approved for a maximum amount but only draw funds as needed, paying interest only on what you use. This is perfect for managing fluctuating cash flow during early franchising stages or handling unexpected expenses.

The choice between secured versus unsecured loans depends on collateral. Secured loans require you to pledge an asset (e.g., equipment, real estate) as security, which typically results in lower interest rates and higher loan amounts. However, you risk losing the asset if you default. Unsecured loans don’t require collateral but are harder to obtain and usually have higher interest rates.

For a deeper dive, see our Franchise Financing Options: Complete Guide.

Exploring Government-Backed Programs

Government-backed programs don’t lend money directly but guarantee a portion of your loan, reducing the lender’s risk and making them more willing to work with you.

SBA loans are the gold standard for small business financing in the U.S. The Small Business Administration backs these loans, often resulting in better terms.

- 7(a) loans are the most popular and flexible SBA option, with amounts up to $5 million. You can use them for working capital, equipment, real estate, or refinancing debt. Learn more from the SBA’s 7(a) Loan Program.

- 504 loans are for major fixed assets like real estate or long-term equipment. They often feature lower down payments and longer repayment terms, perfect for significant infrastructure investments.

These programs can provide the substantial capital needed for franchising with manageable terms. Our Franchise Financing SBA guide has more details. Matching your needs with the right financing is the key to success when learning how to get a business loan.

The Step-by-Step Guide on How to Get a Business Loan

Now let’s walk through the practical steps of how to get a business loan. This roadmap will take you from needing funds to securing approval.

Step 1: Confirming Your Eligibility to Get a Business Loan

Before applying, assess if your business meets the basic requirements most lenders expect.

Lenders typically look for:

- Time in Business: At least two years, showing you’ve weathered challenges and can generate consistent revenue.

- Annual Revenue: A minimum of $50,000 to $250,000, demonstrating enough income to support loan payments.

- Personal Credit Score: 680 or higher is ideal, as it shows you manage finances responsibly. Scores between 550 and 679 may still qualify, but likely with higher interest rates.

- Business Credit Score: A score of 75 or higher (on a 0-100 scale) is considered strong. This reflects how your business pays its bills.

We recommend checking your personal credit for free at annualcreditreport.com to know where you stand.

Step 2: Prepare a Winning Business Plan

Your business plan tells your story and shows lenders why they should invest in your vision. For franchising, this document is critical for demonstrating you have a well-researched expansion strategy.

Your plan should include key components like an executive summary, company description, and market analysis. The financial projections section is especially important. Include realistic revenue forecasts, expense projections, and cash flow analyses showing how the loan will fuel growth. Create scenarios with and without the loan to illustrate its impact.

Your use of funds section must be specific. If you need $200,000, detail how every dollar will be spent (e.g., $75,000 for legal fees, $50,000 for training materials, etc.). This shows lenders you’ve thought through every expense.

The SBA offers excellent guidance for writing your plan at sba.gov/business-guide/plan-your-business/write-your-business-plan.

Step 3: Gather Your Essential Documents

Organizing your documents beforehand shows lenders you’re professional and prepared, which speeds up the process of how to get a business loan.

Key documents include:

- Business Financial Statements: Profit and loss statements (2-3 years), balance sheets, and cash flow statements to show your business’s financial health.

- Personal Financial Statements: Required for personal guarantees, this shows your net worth and financial stability outside the business.

- Tax Returns: 2-3 years of both personal (Form 1040) and business tax returns to verify your financial information.

- Legal Documents: Articles of incorporation, partnership agreements, business licenses, and lease agreements.

- Bank Statements: 6-12 months of business bank statements to show cash flow patterns and responsible account management.

Other documents may include credit reports, collateral documentation, and personal identification. Organizing these in a digital folder will make it easy to share with lenders.

Choosing a Lender and Finalizing Your Loan

With your paperwork in order, the next step in how to get a business loan is selecting the right financial partner and understanding the loan agreement’s fine print.

Comparing Financial Institutions

The best lender is one that understands your franchising vision and offers suitable terms. Compare these common options:

- Traditional Banks: Often offer the most competitive interest rates for established businesses with solid financials. They are a primary source for SBA loans. However, their approval process can be slow and their criteria rigid.

- Credit Unions: As non-profits, they may offer competitive rates with a more personal approach. They might be more flexible if you have strong community ties or are an existing member.

- Online Lenders: These lenders are fast, sometimes funding loans within days. This speed is ideal for moving quickly on franchising plans. The trade-off is typically higher interest rates and shorter repayment terms.

Look beyond the interest rate. Consider the lender’s industry knowledge, reputation, and flexibility. For franchising, it’s beneficial to work with lenders who understand the model. You can explore various Franchise Financing Companies that specialize in this area.

How to get a business loan with the best terms

Getting approved is one thing; getting favorable terms is another. Pay close attention to the details.

- Interest Rates: You’ll see fixed rates (predictable) and variable rates (fluctuate with the market). Under programs like the CSBFP, maximum rates are capped (e.g., prime + 3% for term loans).

- Amortization Period: This is the repayment timeline. Longer terms mean smaller monthly payments but more interest paid over time. Programs like the CSBFP allow up to 15 years for some assets, offering flexibility.

- Loan Covenants: These are the rules you must follow, such as providing regular financial statements or maintaining specific financial ratios. Understand them upfront to avoid future issues.

- Fees: Look out for registration fees (e.g., 2% for CSBFP loans), application fees, and origination fees, as they add to the total cost of borrowing.

Terms are often negotiable, especially if you have strong financials. Compare total costs, not just monthly payments, and don’t be afraid to leverage competing offers.

For more on how terms impact your plans, see our analysis of Franchise Loan Rates. The best loan gives you the flexibility and cash flow to successfully franchise your business.

What If You Don’t Qualify? Exploring Loan Alternatives

If your loan application is rejected, it’s not the end of your franchising journey. It’s simply a detour. First, ask the lender for the specific reasons for the decline—was it your credit score, cash flow, or business history? This feedback provides a roadmap for what to fix.

While you work on building credit for the future, several financing alternatives can keep your expansion plans moving forward:

- Invoice Financing: Sell your outstanding invoices to a financing company at a small discount to get cash immediately. This is ideal for service-based businesses with reliable clients but slow payment cycles.

- Crowdfunding: Raise capital by engaging your community and future customers. You can offer rewards, test market demand for your franchise concept, and build early buzz.

- Revenue-Based Financing: Instead of a fixed payment, you repay the loan with a percentage of your monthly revenue. Payments are lower during slow months, making it easier to manage cash flow.

- ROBS Financing (Rollovers for Business Startups): Use your retirement funds to invest in your business without taxes or penalties. This requires professional guidance but can provide significant, debt-free capital.

- Business Credit Cards: Use these for smaller expenses or to bridge short-term gaps. They are easier to qualify for than loans and help build your business credit history. Our guide to the Best Business Credit Cards for Small Business can help you compare options.

A rejection can be a lesson in strengthening your financial position. Stay flexible, explore these alternatives, and remember that many successful franchises began with creative financing.

Frequently Asked Questions about Business Loans

When business owners explore how to get a business loan for franchising, several common questions arise. Here are the answers to the most frequent concerns.

What credit score is needed for a business loan?

Requirements vary by lender, but here are the general guidelines for your personal and business credit scores:

- Personal Credit Score: Most traditional lenders prefer a score of 680 or higher. A score in the 550 to 679 range might still qualify you for a loan, but likely with higher interest rates. Online lenders may be more flexible.

- Business Credit Score: On the typical 0-100 scale, a score of 75 or higher is considered strong. This score reflects how reliably your business pays its bills.

Because lender requirements vary, it’s wise to shop around to find a financial institution that fits your credit profile.

How much collateral is required for a business loan?

This depends on the loan type and amount. Secured loans require collateral—an asset the lender can claim if you default. Pledging collateral reduces the lender’s risk, often resulting in lower interest rates and higher loan amounts. Unsecured loans don’t require collateral but are harder to get and have higher rates.

Common types of collateral include:

- Real estate (business or personal)

- Equipment (machinery, vehicles)

- Inventory

- Accounts receivable (unpaid invoices)

Lenders use loan-to-value ratios, typically lending 70-80% of an asset’s appraised value. Some lenders also focus on cash-flow lending, prioritizing your revenue generation over physical assets, which is ideal for service-based businesses.

How long does the business loan process take?

The timeline varies dramatically by lender:

- Online Lenders: They are the fastest, with potential funding in 24 to 48 hours or a few business days.

- Traditional Banks: The process is more thorough, taking several weeks to a few months from application to funding.

- SBA Loans: These government-backed loans offer great terms but require patience, often taking 30 to 60 business days or more.

Preparation is the key to speed. Having organized documents, a clear business plan, and a detailed funding request will significantly accelerate the process. Delays are often caused by missing paperwork or vague information.

Conclusion: Secure Your Funding and Franchise Your Future

You now have a clear, manageable path for how to get a business loan. The overwhelming process has been broken down into systematic steps, and the key to success is preparation. A well-organized application with a compelling business plan shows lenders you are a serious business owner with a solid plan for growth.

Most businesses that apply for financing receive approval for at least a portion of their requested amount. Your franchise dreams are achievable with the right financial foundation. Business loans provide the fuel to turn your vision into reality, whether you need funds for legal documents, training programs, or operational infrastructure.

At Franchise Genesis, we understand that securing financing is just one piece of the franchising puzzle. Our expertise goes beyond helping you understand how to get a business loan; we guide you through every aspect of building a franchise system that attracts both capital and quality franchisees.

Ready to transform your successful business into a scalable franchise? Our comprehensive Guide to Franchising shows you how.

If you’re ready to partner with experts who understand both the financial and operational sides of franchising, contact us to learn about our services for franchisors and let’s build the franchise system of your dreams.